This article is cross-posted from the Tax Justice Blog.

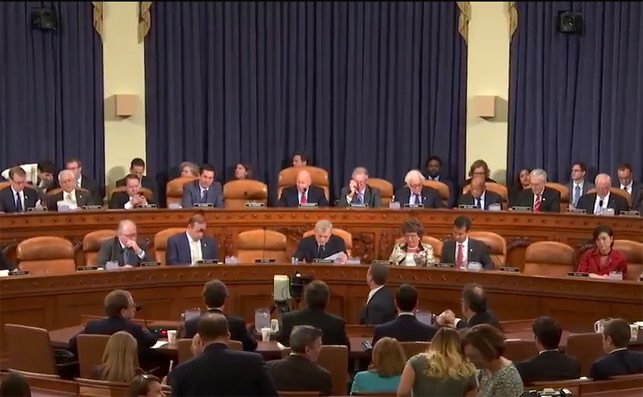

Today the House Ways and Means Committee will hold its first tax reform hearing of 2017, which marks the official opening of the tax reform debate in Congress. True tax reform, if the committee sought to achieve it, could create more jobs and ensure companies are paying their fair share by cracking down on the massive offshore tax avoidance that companies engage in. Unfortunately, the panel of witnesses for today’s hearing is largely made up of representatives of various major corporations that are beneficiaries of the loopholes in our current corporate tax laws. Given this, it seems likely that these panelists will not push for a fairer corporate tax code, but rather a code that allows them to avoid even more taxes and incentivizes moving more jobs offshore.

The biggest tax avoider represented at the hearing is AT&T, which received $38 billion in tax breaks over the past eight years, meaning that it received more tax breaks than any other Fortune 500 company during that time. Over the past 10 years, the company managed to pay an average federal income tax rate of just 11.3 percent, less than a third of the statutory rate of 35 percent. In 2011, it managed to pay nothing in federal income taxes, despite earning $12 billion in profits.

Another company engaged in offshore tax avoidance represented at the hearing is Emerson Electric. This company is currently avoiding taxes on $5.2 billion in earnings that it’s holding offshore. Emerson also has as many as 68 subsidiaries in tax haven jurisdictions. Perhaps most suspiciously, the company has disclosed having a subsidiary in Bermuda named Emerson Electric Ireland Limited, which is connected to another subsidiary they report in Ireland. This structure appears to be identical to the subsidiary structure used by Apple and other companies to shelter profits from tax, which is known as the “double Irish.”

The third tax avoider represented on the panel is S&P Global. This company is avoiding taxes on $1.7 billion in earnings it is holding offshore. The company discloses owning 20 subsidiaries in foreign tax havens. In addition, S&P Global has advocated for a repatriation tax break that is more egregious than most of those previously considered. Their plan would allow companies to repatriate their earnings tax-free as long as they invest 15 percent of these funds in a short-term market rate bond. This would allow corporations to almost entirely avoid paying the over $750 billion they owe in taxes on their offshore money.

Real tax reform would mean ending the ability of companies to avoid taxes on their offshore income and cleaning out the corporate tax code of the kinds of tax breaks that allow AT&T to pay so little year after year. Ending deferral, the ability of companies to defer taxes on their offshore income, would encourage job creation in the United States by making it so that U.S. companies are paying the same tax rate on income earned in the U.S. as they do in countries throughout the world. Similarly, cleaning out the corporate tax code would improve the economy by creating a more even playing field since certain companies would no longer be given an artificial advantage due to special interest tax breaks they receive.

Considering the companies represented at today’s hearing, it will not be surprising to hear proposals moving in the exact opposite direction, such as a proposal to enact a territorial tax system. Rather than making corporations pay their fair share, a territorial system would allow these and many other companies to avoid even more in taxes because they would never have to pay a cent on income they earn or artificially shift offshore. Such proposals should be rejected if lawmakers really want to create jobs and economic growth.

Richard Phillips is a Senior Policy Analyst at The Institute on Taxation and Economic Policy