U.S. Court of Appeals Upholds the Corporate Transparency Act

“The Court’s decision confirms what Congress understood and intended when it originally passed this legislation: that anonymous companies are drivers of fraud, drug trafficking, and the threats posed by terrorists and transnational criminal organizations.”

- Erica Hanichak, deputy director of the FACT Coalition.

Latest News

Big U.S. Corporations Reaped Billions through Tax Havens in 2025, New Transparency Requirements Reveal

New disclosure requirements show that huge American corporations lowered their tax bills by billions of dollars through the use of tax havens in 2025, while U.S. anti-abuse rules struggled to keep up.

After Decades, U.S. Housing Market Now Has New Safeguards Against Dirty Money

“FinCEN’s new reporting requirements will help deter the most egregious cases of money laundering through real estate while giving law enforcement and national security officials better tools to investigate and tackle these flows.” – FACT Executive Director Ian Gary

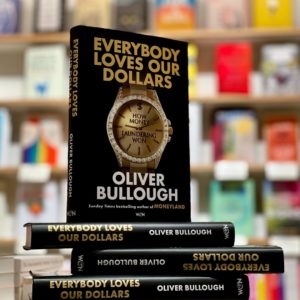

FACT Book Talk: Everybody Loves Our Dollars – How Money Laundering Won with Author Oliver Bullough

RSVP now for FACT’s virtual book talk with Oliver Bullough, author of the new book “Everybody Loves Our Dollars – How Money Laundering Won” on February 26 from 12-1 p.m.