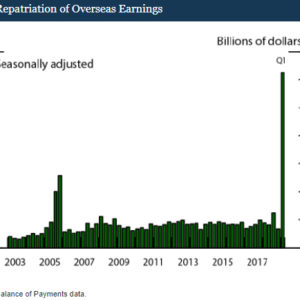

For years, corporations stockpiled profits offshore to avoid paying U.S. taxes, with the sum growing to $2.6 trillion by 2017. Corporate apologists suggested that this cache was necessary because the corporate tax rate was too high, and they asserted that if the United States lowered its tax rate, corporations would repatriate those profits, pay taxes, invest in workers and we’d all win.

In 2016, then candidate Trump claimed there is as much as $5 trillion overseas and a tax break on those earnings would cause “all of this money to come back into our country” and “turn America into a magnet for new jobs.”

Based on previous experience with a repatriation holiday in 2004, critics argued that another repatriation tax break would be a major windfall to corporations that would enrich shareholders and accomplish little else.

In the end, corporations and their allies got their way.