The U.S.’s top 50 public corporations have $1.6 trillion stashed offshore, and current tax reform proposals by President Trump and Congressional leadership will only make the problem worse.

This week, millions of Americans are filing their tax returns and mailing Uncle Sam a check. At the same time, the 50 biggest public companies in the U.S., including Pfizer, Goldman Sachs, GE, Chevron, Walmart, and Apple, are avoiding taxes while their huge pile of offshore cash grows.

In a new report called “Rigged Reform” Oxfam used corporate financial, lobbying, and investor disclosures to reveal that the 50 largest U.S. companies used an opaque and secretive network of at least 1,751 subsidiaries in tax havens to avoid paying their fair share of taxes.

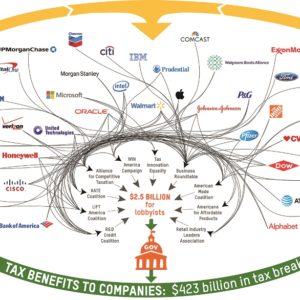

Resisting calls to “drain the swamp,” these companies sink deep in the DC muck and mire—with eye-popping results. The report, which updates Oxfam’s analysis from our “Broken at the Top” report last year, reveals that since 2009, these 50 companies alone have spent $2.5 billion in federal lobbying—almost $50 million for every member of Congress. Oxfam estimates that for every $1 these companies spent lobbying on tax issues, they received an estimated $1,200 in tax breaks.