Tax Day for You, Tax Holiday for Multinationals

State Legislators are Increasingly Stepping in to Combat Offshore Tax Haven Abuse

It’s Tax Day. Odds are, you’ve already filed your taxes. Maybe you filed through a tax filing software, or maybe you hired an accountant to help you puzzle through the deductions you might be eligible for. Or, maybe you filed yourself, old-school-style, filling out your 1040 in your kitchen. Or, maybe you forgot, and this blog will serve as a last-second reminder—go file your taxes!

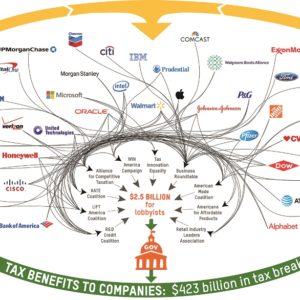

All of this is to say: you’ve fulfilled your tax responsibilities. No doubt, the biggest corporations have filed theirs’s too. But, unlike you, they have an army of accountants to ensure they take advantage of every last loophole and gimmick to cut down on their tax liability to near nothing.