Robert Stewart

Robert Stewart is a Tax and Disclosure Advocate with Public Citizen, and currently represents District 23 in the Alabama State Senate. Previously, he served as a district staffer in the U.S. House of Representatives where he was responsible for a variety of constituent stakeholder concerns with the IRS, VA, government/municipal relations, and community outreach. Prior to that position, he had a wide range of accounting experiences being employed in the nonprofit, state government, corporate, and regional public accounting firm sectors. He was awarded a bachelor’s degree in accounting from Tuskegee University and earned a master’s degree in accounting from Kennesaw State University. Additionally, he is a 2019 graduate of the Congressional Black Caucus Institute Boot Camp, which trains emerging leaders for public service.

Susan Harley

Susan is the deputy director for Public Citizen’s Congress Watch division, where she helps coordinate all aspects of the division’s advocacy across multiple issue campaigns, specializing in financial reform, international tax issues and open government initiatives. Susan received her bachelor’s degree from Michigan State University and received her J.D., cum laude in public law and regulation from MSU’s College of Law. She is a member of the State Bar of Michigan. Prior to joining Public Citizen, she worked as the Michigan policy director of Clean Water Action and Clean Water Fund.

Media Appearances: Susan has been quoted or published in The Wall Street Journal, NPR, Roll Call, The Hill, American Banker, The Nation, TIME, Consumerist, Detroit News, Huffington Post and ValueWalk among other media. Susan has appeared on C-SPAN, Boom Bust, America’s Workforce Radio, The Union Edge, Uprising with Sonali, Living Room, Saturday Morning Talkies, KBOO/Portland and other broadcast media outlets.

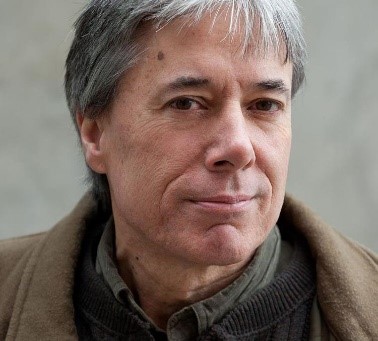

Chuck Collins

Chuck Collins is the Director the Program on Inequality and the Common Good at the Institute for Policy Studies where he co-edits Inequality.org.

He is author of the forthcoming book, The Wealth Hoarders: How Billionaires Pay Millions to Hide Billions (Polity Press), about the wealth defense industry. He is an expert on tax policy, illicit finance, dynasty trusts, family offices, and solutions to individual and corporate wealth hiding. He has written numerous articles about the Panama Papers, illicit finance in real estate, the Luanda Leaks, the wealth defense industry, and how lack of transparency contributes to economic inequality.

He is author of a number of studies examining anonymous shell companies and luxury real estate including Towering Excess: The Perils of the Luxury Real Estate Boom for Bostonians and Who is Buying Seattle?

Collins is author of the popular book, Born on Third Base (Chelsea Green) and Is Inequality in America Irreversible? is published by the Oxford, UK-based Polity Press. He is co-author, with Bill Gates Sr., of Wealth and Our Commonwealth, (Beacon Press, 2003), a case for taxing inherited fortunes. He is a board member of the Patriotic Millionaires and launched a global call in January 2020, at the Davos World Economic Forum, for millionaires and billionaires to pay their fair share of taxes and stop global tax evasion.

Steve Wamhoff

Steve Wamhoff is ITEP’s director of federal tax policy. In this role, he is responsible for setting the organization’s federal research and policy agenda. He is the author of numerous reports and analyses of federal tax policies as well as in-depth policy briefs that outline how the federal income tax and corporate tax code can be overhauled to improve tax fairness.

Just before taking on the role of ITEP’s director of federal tax policy, Steve spent more than two years as the senior tax policy analyst for Sen. Bernie Sanders and as a member of the senator’s Budget Committee staff. In this capacity, he wrote legislation related to personal income and corporate income taxes, financial transaction taxes, estate taxes and tax avoidance.

Before joining Sen. Sanders’ staff, Steve had previously worked for ITEP and its c(4) partner Citizens for Tax Justice for more than eight years. During this time, he built expertise is analyzing tax policies and their effect on federal revenue as well as on people across the income spectrum. Notably, he wrote reports on proposals to extend the George W. Bush tax cuts, as well as proposals to eliminate tax breaks for for investors and corporations as a way of financing health care reform and other initiatives.

Earlier in his career, Steve worked for the Social Security Administration’s Office of Policy and the Coalition on Human Needs. He received a Juris Doctor and Master’s in Public Policy from Georgetown University and a bachelor’s from New York University.