FACT Sheet

Business Case for Ending Anonymous Companies

Anonymous companies are behind just about every financial crime. They are the vehicle of choice for laundering money obtained through illicit activity. Schemes involving terror financing and the trafficking of drugs, illegal weapons, and humans all use anonymous companies to move money, fund operations, and allow bad actors to escape with the proceeds of their crimes and impunity.

The pervasive use of secret shell and front companies also impacts the broader economy. As such, more and more businesses are speaking out.

Anonymous Companies Are Used to Disrupt Supply Chains

| “When the true owners of companies put their own name on corporate formation papers, it increases integrity in the system and provides a higher level of confidence when managing risk, developing supply chains and allocating capital.”

CEOs from Allianz, Dow Chemical, Kering Group, Salesforce, Unilever, and Virgin Group1 |

A government contractor’s employee tried to scam his employer’s subcontractors by using shell companies to bill them for services his employer delivered. He then tried to use a bank account in the name of his anonymously owned company in Alabama to steal $650,000 from his employer and other family-owned subcontractors.2

Anonymous Companies Used to Fraudulently Win Contracts

After a large multinational company was fined $30 million for fulfilling contracts with shoddy bulletproof vests, it used a wholly owned subsidiary, registered as an anonymous LLC, to meet the requirements to bid on U.S. contracts. Then, over 5 years, paid bribes in order to gain insider information allowing them to underbid competitors. The company subsequently won defense contracts worth $7.1 million and, once again, sold defective bulletproof vests to federal, state, and local governments.3

Anonymous Companies Falsely Compete for Contracts Meant for Small Business

Small Business Owners Support Legislation Requiring Disclosure of Beneficial Owners |

Keith Hedman recruited Dawn Hamilton to set up an anonymous company in Virginia. They successfully deceived the Small Business Administration and were able to fraudulently secure federal government contracts worth $31 million from NASA and other agencies. Hedman then illegally passed the majority of the work to a larger company. The scam generated almost $7 million in salary and payments for the conspirators that they should not have received.5

Anonymous Companies Provide a Conduit for Piracy

A report by the London-based think tank Chatham House found that proceeds of stolen oil — and the oil itself — move through anonymous companies to escape accountability. As reported in The Economist, “Profits are laundered abroad in financial hubs, including New York, London, Geneva and Singapore. Money is smuggled in cash via middlemen and deposited in shell companies and tax havens… Some of the proceeds—and stolen oil—end up in the Balkans, Brazil, China, Indonesia, Singapore, Thailand, the United States and other parts of west Africa.”6

Anonymous Companies Are Used by Patent Trolls and Upend Entrepreneurs

Patent trolls have used anonymous companies to target small business owners. And with few legal resources, some business owners find themselves paying unnecessary licensing fees or spending time and money to defend themselves against bogus infringement claims.7

Anonymous Companies Enable Counterfeiters Who Undercut Honest Businesses

Four Colorado men used a network of more than 20 shell companies to finance an illicit counterfeiting ring. They imported and sold fake merchandise from China wrongly marked as official Denver Broncos products as well as counterfeit goods masquerading as official merchandise for a number of other professional and college teams throughout the country, thereby undercutting legitimate American businesses.8 Trafficking counterfeit goods is the second-largest illicit trade activity, valued at roughly $250 billion annually, according to U.S. Immigration and Customs Enforcement.9

Senior Executives Are Fed Up

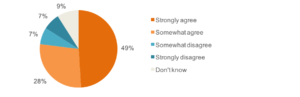

| 91% of senior executives believe it is important to understand the ultimate beneficial ownership of the entities with which they do business.

– Ernst & Young, 201610 |

According to Ernst & Young’s Fiscal Year 2016 Global Fraud Survey, 91% of senior executives believe it is important to know the ultimate owner of the entities with which they do business. For financial institutions, in particular, it is costly to access relevant information and meet increasing due diligence and anti-corruption requirements. Ready access to ownership information would save time, money, and strengthen the integrity of the financial system.11

There Is a Bipartisan Legislative Solution

Rep. Carolyn Maloney (D-NY), Rep. Peter King (R-NY), Sen. Ron Wyden (D-OR), and Sen. Marco Rubio (R-FL) were sponsors of the Corporate Transparency Act of 2017 [H.R.3089/S.1717] and Senators Sheldon Whitehouse (D-RI) and Charles Grassley (R-IA) were sponsors of the True Incorporation Transparency for Law Enforcement (TITLE) Act [S.1454], all in the last Congress. New bipartisan bills are expected soon. All of these bills require companies to disclose their beneficial owner(s) when they incorporate and keep their ownership information up to-do-date.

Businesses support these bills to end the distortions in the marketplace created by anonymous companies.12

For more information, please contact Clark Gascoigne at cgascoigne@thefactcoalition.org.

__________

Footnotes:

- Andrew Liveris, Paul Polman, Marc Benioff, François-Henri Pinault, Oliver Bäte, and Josh Bayliss, “U.S. Government Action Crucial to Fighting Corruption,” The B Team, July 12, 2017, http://bit.ly/2vGYDLQ.

- Global Witness, “Hidden Menace,” July 2016, https://www.globalwitness.org/en/reports/hidden-menace/.

- Bredderman, Will, “Company Making NYPD Body Cameras Has History of Defective Merchandise and Bribery.” New York Observer, November 11, 2016, http://bit.ly/2uuZUa5.

- Small Business Majority, “Opinion Poll: Small Business Owners Support Legislation Requiring Transparency in Business Formation,” April 4, 2018, https://smallbusinessmajority.org/our-research/government-accountability/small-business-owners-support-legislation-requiring-transparency-business-formation.

- United States Department of Justice, “Security Contractors Plead Guilty to Illegally Obtaining $31 Million From Contracts Intended for Disadvantaged Small Businesses,” March 18, 2013, https://www.justice.gov/usao-edva/pr/security-contractors-plead-guilty-illegally-obtaining-31-million-contracts-intended.

- The Economist, “A Murky Business,” October 3, 2013, https://www.economist.com/baobab/2013/10/03/a-murky-business

- Stephen Rouzer, “MSA Speaks Out: Sunlight is the Best Disinfectant in Government Contracting,” Main Street Alliance, October 28, 2016, http://www.mainstreetalliance.org/sunlight_is_the_best_disinfectant_in_government_contracting.

- U.S. Immigration and Customs Enforcement, “4 Colorado men charged in counterfeit Denver Broncos merchandise scheme,” August 3, 2016, https://www.ice.gov/news/releases/4-charged-counterfeit-denver-broncos-merchandise-scheme.

- U.S. Immigration and Customs Enforcement, “Former Colorado police officer sentenced for selling counterfeit Denver Broncos merchandise,” January 25, 2017, https://www.ice.gov/news/releases/former-colorado-police-officer-sentenced-selling-counterfeit-denver-broncos.

- Ernst & Young, “EY – Global Fraud Survey 2016,” April 18, 2016, https://go.ey.com/2vGBTLN.

- Ernst & Young, “EY – Global Fraud Survey 2016,” April 18, 2016, https://go.ey.com/2vGBTLN.

- Andrew Liveris, Paul Polman, Marc Benioff, François-Henri Pinault, Oliver Bäte, and Josh Bayliss, “U.S. Government Action Crucial to Fighting Corruption,” The B Team, July 12, 2017, http://bit.ly/2vGYDLQ.