Small Businesses Are Harmed by Anonymous Companies

Anonymous companies have been used by rogue employees to embezzle money, fraudulent vendors to undermine supply chains, and bogus competitors to steal contracts.

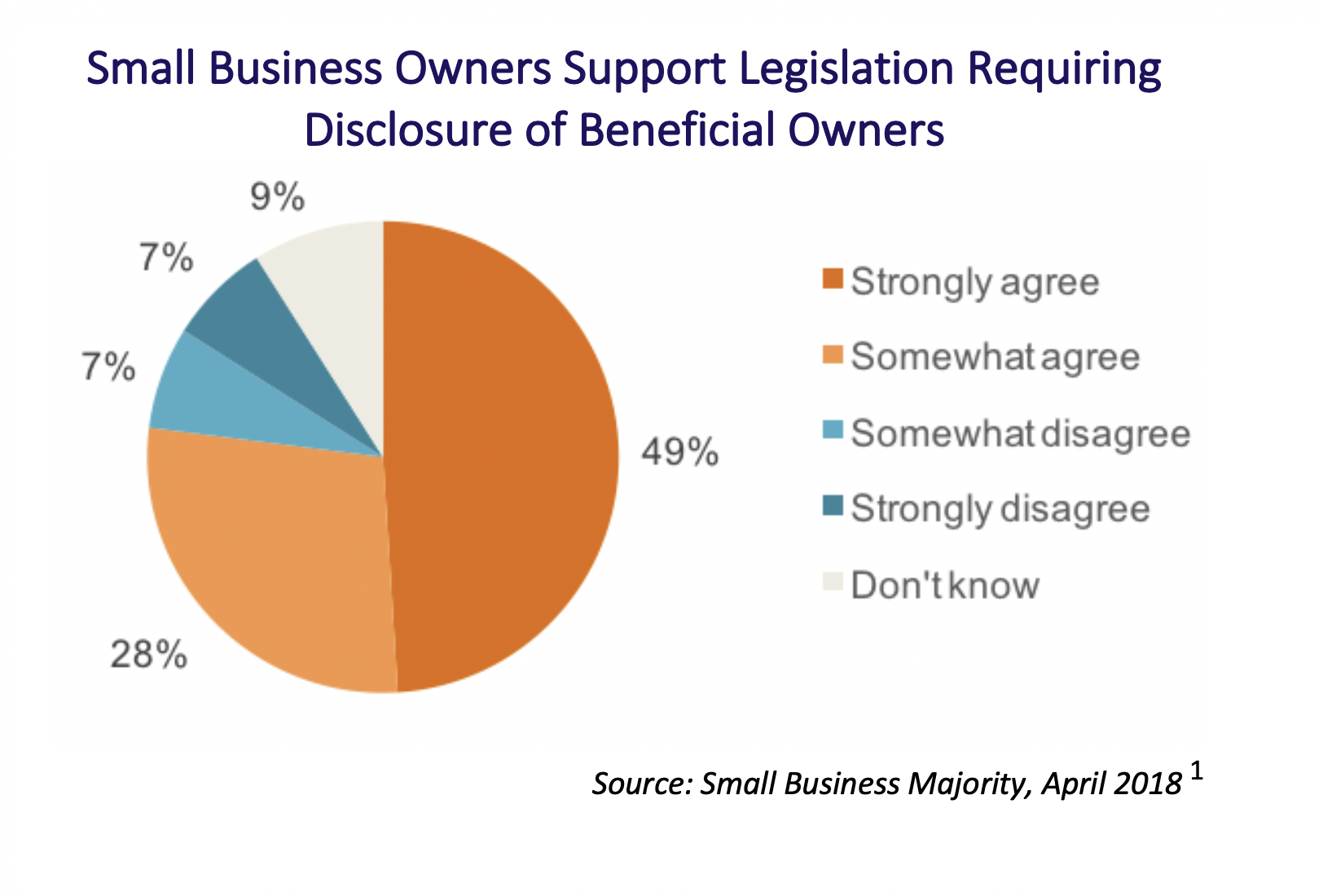

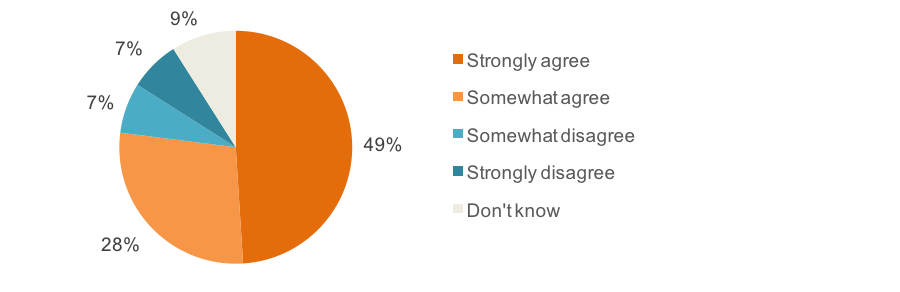

Small Business Owners Support Legislation Requiring Disclosure of Beneficial Owners |

| Source: Small Business Majority, April 2018 [1] |

With fewer resources than larger enterprises, small businesses are often easy targets for scammers and criminals.

Anonymous Companies Gouge Small Businesses and Their Customers

An Illinois man created an anonymous company that appeared to be a subcontractor to his employer, a small air conditioning repair business. He used it to submit fraudulent invoices to both his own employer and its customers despite providing no service to either party. The employee stole approximately $350,000 before getting caught.[2]

Anonymous Companies Are Used by Patent Trolls to Target Entrepreneurs

Patent trolls (i.e., predatory companies that obtain the rights to patents in order to profit by means of licensing or litigation, rather than by producing their own goods or services) use anonymous companies to target small businesses. With few legal resources, some business owners find themselves paying unnecessary licensing fees or spending time and money to defend themselves against bogus infringement claims.[3]

“[W]e are asking Congress to pass a law to stop the creation of anonymous shell companies that facilitate crimes that victimize small businesses and our employees…”

— ReShonda Young

Owner, Popcorn Heaven

Waterloo, Iowa [4]

Anonymous Companies Hurt Honest Competition

A Maryland woman won government contracts by submitting extremely low bids, undercutting honest businesses. With her co-conspirators, she then subcontracted the work before disappearing without paying the subcontractors. Money and contracts were laundered through a series of 15 shell companies in Maryland, Delaware, Georgia, Nevada, North Carolina and Tennessee.[5]

Anonymous Companies Exploit Programs Meant for Legitimate Small Businesses

A former construction company executive in Pennsylvania used anonymous companies to take advantage of a program for small businesses owned by minorities he was not eligible for. Hiding behind a Connecticut-based company for 15 years, he won contracts worth $136 million in Pennsylvania alone.[6]

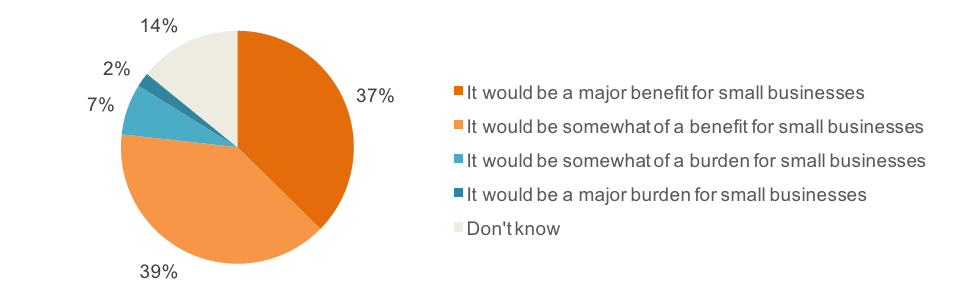

Small Business Owners Say Ownership Transparency Would Benefit Them |

| Source: Small Business Majority, April 2018 [7] |

Beneficial Ownership Disclosure Will Not Burden Small Business Owners

Current proposals call for the collection of four pieces of readily known and accessible information: name, address, date of birth, and a driver’s license or other identification number. This is less information than is necessary to acquire a library card in any of the 50 states.[8]

According to the U.S. Small Business Administration, approximately 78% of all businesses in the U.S. are non-employer firms, meaning that there is only one person in the enterprise.[9] Small business owners will not have trouble identifying the owner of their business.

Given the potential for harm, it is not surprising that more than three quarters of small business owners felt that the tradeoff of reporting burden vs. benefits was worth it.[10]

There is a Bipartisan Solution

The bipartisan Corporate Transparency Act of 2019 [H.R.2513] would require U.S. companies to disclose their beneficial owner(s) to the Treasury Department when they incorporate, and keep their ownership information up to-do-date. Bipartisan bills in the Senate include a sister bill to the Corporate Transparency Act [S.1978], as well as the TITLE Act [S. 1889], and the draft ILLICIT CASH Act.

These measures are endorsed by a growing number of businesses and businesses trade associations, including Small Business Majority and Main Street Alliance.[11]

Footnotes:

[1] Small Business Majority, “Opinion Poll: Small Business Owners Support Legislation Requiring Transparency in Business Formation,” April 4, 2018, http://bit.ly/2mmX6KH.

[2] United States Department of Justice, “Illinois Man Pleads Guilty to Fraud and Money Laundering Charges,” July 27, 2016 https://www.justice.gov/usao-edmo/pr/illinois-man-pleads-guilty-fraud-and-money-laundering-charges

[3] “Small businesses support laws that end anonymous companies,” Main Street Alliance, July 10, 2017, http://bit.ly/2lYLkpo.

[4] ReShonda Young, “Join the fight against anonymous shell companie,” The Gazette, May 13, 2016, http://bit.ly/2lTkX4c.

[5] United States Department of Justice, “Clinton Woman Pleads Guilty In $2.3 Million Government Contract Fraud Scheme,” August 7, 2013, http://www.justice.gov/usao/md/news/2013/CLINTONWOMANPLEADSGUILTYIN2.3MILLION.html.

[6] Global Witness, “Hidden Menace: How secret company owners are putting troops at risk and harming American taxpayers,” July 12, 2016, http://bit.ly/HiddenMenace.

[7] Small Business Majority, “Opinion Poll: Small Business Owners Support Legislation Requiring Transparency in Business Formation,” April 4, 2018, http://bit.ly/2LHdwrW.

[8] Press Release, “Report Demonstrates Ease of Establishing Anonymous Shell Companies,” Global Financial Integrity, March 21, 2019, accessible at https://www.gfintegrity.org/press-release/report-demonstrates-ease-of-establishing-anonymous-shellcompanies/.

[9] Small Business Administration, “Frequently Asked Questions,” September 2012; https://www.sba.gov/sites/default/files/FAQ_Sept_2012.pdf.

[10] Small Business Majority, “Opinion Poll: Small Business Owners Support Legislation Requiring Transparency in Business Formation,” April 4, 2018, http://bit.ly/2LHdwrW.

[11] For a full list of groups supportive of beneficial ownership transparency, please visit: http://bit.ly/2MKKedo.