“Just the FACTs” is a round-up of news stories and information regarding efforts to combat corrupt financial practices, including offshore tax haven abuses, corporate secrecy, and money laundering through the financial system.

Send feedback or items for future newsletters to Thomas Georges at tgeorges@thefactcoalition.org

Here is the State of Play

House Hearing Puts Beneficial Ownership Implementation on Center Stage

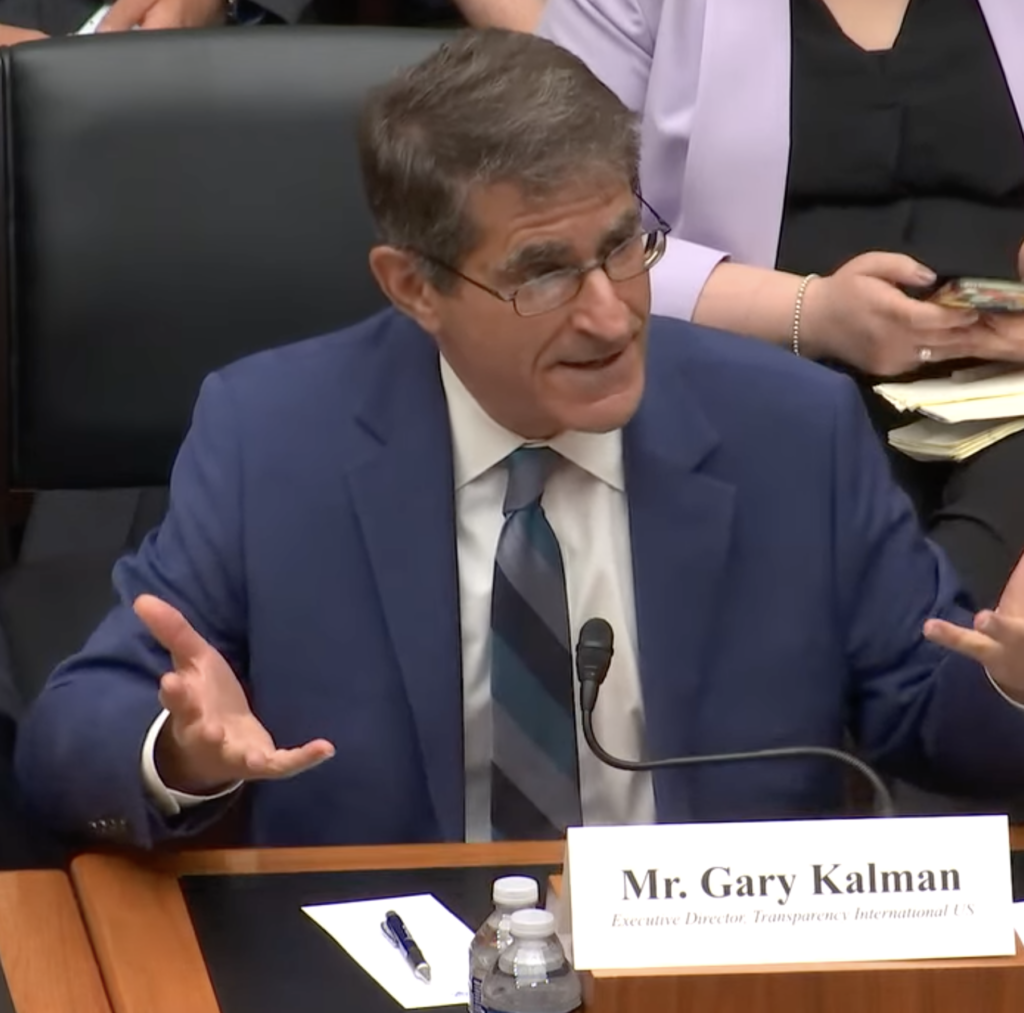

On July 29, the House Financial Services Subcommittee on National Security, Illicit Finance, and International Financial Institutions held a hearing on the current status of Treasury’s implementation of the Corporate Transparency Act (CTA), which requires certain entities formed or operating within the U.S. to report their true, “beneficial” owners to the Financial Crimes Enforcement Network (FinCEN). Among the witnesses was Gary Kalman, executive director of FACT-member Transparency International-U.S.

During their testimonies, both Mr. Kalman and Mr. Pete Selenke – a witness representing the American Bankers Association (ABA) – outlined the need for substantial revisions to existing draft rulemakings implementing the CTA, including the need to ensure that financial institutions are able to access collected beneficial ownership information pursuant to their full range of anti-money laundering and counter-terror financing (AML/CFT) responsibilities.

Witnesses further underscored the importance of verifying information submitted to the database. During his testimony, Mr. Kalman of Transparency International-U.S. noted, “One of the most important things about getting this right and making sure it is effective is that the data is verified.” He continued, saying that FinCEN needs funding for “licenses to access other databases. They need to be able to make sure that their systems are compatible. That takes a lot of money, and that is not currently in FinCEN’s budget…If these rules are going to work, they need that targeted funding.”

Likewise, Mr. Selenke, on behalf of the ABA, reaffirmed the value of verified data to financial institutions with anti-money laundering obligations: “The beneficial ownership registry must be a reliable and authoritative source of information. The federal government must make sure the information in the registry is accurate…if the accuracy of the registry’s information is in doubt, the banks may not be able to use the database at all.”

Funding was also recognized as crucial to making sure there is staff in place to effectuate these outcomes: in her opening statement, Rep. Joyce Beatty (D-OH) noted that proposed cuts to FinCEN’s budget put forward by the House majority for FY2024 may force the bureau to lay off core staff working on CTA implementation. Mr. Kalman also argued for additional funding for FinCEN to drive the timely implementation of the law, provide appropriate responsiveness to inquiries from business groups and financial institutions with regards to compliance, and ensure effective verification of collected information.

Read FACT’s statement for the record submitted ahead of Tuesday’s hearing here. Representative Joyce Beatty (D-OH) submitted FACT’s statement, alongside a statement from FACT-member Citizens for Responsibility and Ethics in Washington (CREW), into the record during her opening remarks.

Treasury Names Top Sanctions Official as Next Permanent FinCEN Director

The U.S. Treasury Department named its chief sanctions official, Andrea Gacki, to the position of permanent FinCEN Director last week. For nearly two years, FinCEN has been under the leadership of Acting Director Himamauli Das, who presided over much of the implementation of the landmark Corporate Transparency Act, as well as the forthcoming rule to tackle real estate money laundering.

In March, the FACT Coalition led a letter to Treasury Secretary Yellen arguing that the ongoing lack of a permanent director contradicted “both the gravity of FinCEN’s mission and the stated national security, economic, and criminal justice objectives of the Administration.” The letter was signed by 26 civil society, national security, and environmental organizations, and called for the appointment of a permanent Director “with an urgency reflective of the widely recognized importance of the agency and its mission.”

With permanent leadership in place, the bureau will be better placed to move forward with its substantial regulatory agenda, including the finalization of rulemakings necessary to implement the CTA, and drafting new regulations cracking down on money laundering through U.S. real estate and private investment markets.

Despite the opportunity presented by the appointment of Ms. Gacki, there remains an urgent need for FinCEN to accelerate the implementation of its regulatory agenda. In a statement, FACT executive director Ian Gary noted that “FinCEN can’t take its foot off the gas… In December, the United States will be on the center stage as the host of the UN Convention Against Corruption Conference in Atlanta. We expect FinCEN to keep up the pace to deliver U.S. anti-corruption reforms ahead of the summit, and demonstrate its global leadership on these issues.”

Latest from FACT

FACT condemned reports of direct intervention by the Organization for Economic Cooperation and Development (OECD) in the Australian government’s plans to institute public country-by-country reporting (PCbCR) of tax and operational data for large multinationals, and called upon the Albanese government to “swiftly finalize this important legislation without any further changes.”

“Despite inappropriate pressure from the OECD and multinationals’ efforts to keep investors in the dark, there is unstoppable global momentum towards greater corporate tax transparency,” said FACT executive director Ian Gary. “Australia has the opportunity to be in the vanguard of this global movement to reveal corporate tax dodging, aid investors, and inform a broader set of stakeholders than private reports under current OECD processes do now.”

Press Release: Treasury Names Director to Lead Financial Crime Fighting Bureau

The FACT Coalition welcomed the appointment of Andrea Gacki to lead the Financial Crimes Enforcement Network, and urged FinCEN to swiftly advance its regulatory agenda in order to end the abuse of U.S. markets by foreign and domestic bad actors.

“The U.S. is the easiest place in the world to hide dirty money,” said Ian Gary, executive director of the FACT Coalition. “In naming a permanent director, Treasury has taken a crucial step to empower FinCEN to better safeguard the U.S. financial system and defend against ever-evolving financial threats.”

Read FACT’s statement for the record submitted ahead of Tuesday’s House Financial Services Subcommittee hearing on FinCEN’s implementation of the Corporate Transparency Act.

From the statement: “The Corporate Transparency Act represents the most important individual legislative instrument in decades toward ending the U.S.’s status as the world’s top financial secrecy jurisdiction. As the bureau tasked with implementing this vital law, it is important that FinCEN faces appropriate scrutiny – and receives sufficient support – from Congress with regard to these ongoing efforts.”

FACT in the News

Quoted In: Treasury’s Sanctions Chief Is Appointed Director of Financial Crimes Bureau

FACT’s statement on the appointment of Andrea Gacki to lead the Financial Crimes Enforcement Network was quoted in coverage by the Wall Street Journal’s Dylan Tokar.

“Financial-transparency groups, including the FACT Coalition, earlier this year called on Yellen to appoint a permanent director of FinCEN, contending that the lack of a permanent director undermined its ability to implement the ownership registry and fulfill its other objectives.”

Quoted In: Australia spikes plan to force companies to disclose global tax data

Ian Gary was quoted in coverage of Australia’s delayed PCbCR legislation by ICIJ’s David Kenner.

“While Australia’s delay in implementing public country-by-country reporting is disappointing, the revised measures outlined by the government would still represent a monumental leap forward for international tax transparency,” said Gary. By passing this legislation, “Australia would lead the pack in providing investors, lawmakers, and other stakeholders with information that they have been seeking for years.”

Recent and Upcoming Events

July 12: Report Launch: Dirty Money: The Role of Corruption in Enabling Wildlife Crime

Read the newest report from the Wildlife Justice Commission, which outlines the intrinsic links between wildlife crime and corruption.

From the report: “Criminal networks may use money laundering techniques to disguise or conceal the origin of financial proceeds and assets generated from illicit activities, such as wildlife trafficking and the corruption that enables it. Tackling the financial flows and recovering the proceeds from these crimes is identified as a key action for States parties under UNCAC Resolution 8/12, to remove the profit from criminality and to prevent the proceeds from being invested in the commission of further crimes. However, there are few examples of investigations or prosecutions of money laundering related to wildlife crimes, and even fewer examples of investigations of money laundering deriving from corrupt acts that were linked to wildlife crimes.”

Senator Chris Van Hollen (D-MD) noted rising global momentum for public country-by-country reporting to SEC Chairman Gary Gensler during the Senate Appropriation Committee’s annual review of the SEC’s discretionary budget.

Senator Van Hollen’s recently-reintroduced bill, the Disclosure of Tax Havens and Offshoring Act, would require the SEC to begin the rulemaking process to mandate PCbCR for large U.S. multinational filers in line with disclosures already provided by these entities to the IRS. In his remarks, Van Hollen noted the ongoing efforts of the Financial Accounting Standards Board (FASB) to require greater disaggregation of tax data by public businesses, as well as recent progress in the EU and Australia towards more effective disclosures.

About the FACT Coalition