How the Tax Code Favors

Large Multinational Businesses Over Small and Domestic Ones

Background

Despite the promises of its proponents, the passage of the Tax Cuts and Jobs Act (TCJA) did not restore fairness to the business tax code. Under the new system, multinational companies will continue to be able to shift their profits offshore to avoid paying taxes. In fact, a study by the Congressional Budget Office (CBO) found that multinational corporations will continue to shift $235 billion in profits offshore to avoid taxes each year.1 Unlike the large multinational companies, small and domestic businesses are not able to take advantage of tax havens, which leaves them picking up the tab for the avoidance behaviors of their competitors.

We need a tax code that creates an even playing field between large multinational corporations and small and domestic businesses, which means ending the ability of the former to engage in offshore shell games.

Incentivizing New Tax Avoidance Schemes

Under the new law, rather than a 21% tax rate, multinational corporations pay between zero and 10.5% — a 50% or greater discount — on all foreign profits. Those lower rates incentivize multinationals to shift income offshore, often through intellectual property or interest payments, to avoid paying higher U.S. taxes.

In contrast, purely domestic companies are left paying the full 21% tax rate on their earnings. A local pizza or coffee shop does not have the resources to set up a subsidiary in the Caymans Islands to shift expenses and earnings offshore to dodge taxes. That’s how the TCJA gives multinationals a substantial financial advantage over U.S. small and domestic companies.

Small Businesses Want Fairness

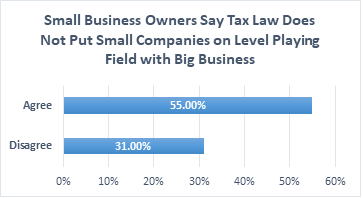

Small businesses understand the new tax law favors large businesses. In a poll conducted by Businesses for Responsible Tax Reform, a majority of small business owners say the tax law favors large corporations over small businesses.2

- By a 24% margin (55% to 31%) small business owners say the tax law does not put small businesses on a level playing field with big businesses.

- By a 30% margin (50% to 20%), small business owners say that corporations and the wealthy benefit most from the tax law rather than small businesses and the middle class.

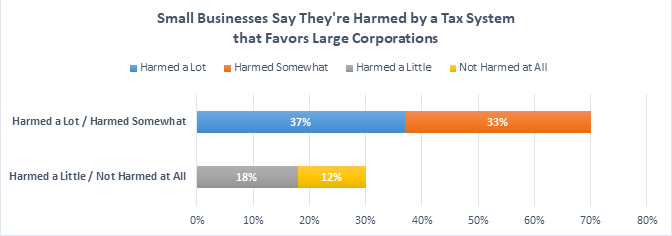

In a separate poll conducted by the Small Business Majority:3

- 7 in 10 small business owners said they are harmed by a tax system that favors large corporations.

- 85% of small businesses want large corporations and wealthy Americans to pay their fair share of taxes.

Create a Level Playing Field for Small Business

Big businesses have several advantages over small ones that are inherent in a free market economy — bulk purchasing discounts, easier and cheaper access to capital, and more. But when the government puts it thumb on the scale to benefit big businesses over small through tax preferences, it is an unfair advantage that must be fixed.

“[W]hen the government puts it thumb on the scale to benefit big businesses over small through tax preferences, it is an unfair advantage that must be fixed.”

Offshore tax dodging that favors multinationals is not inevitable. We can adopt policies that take away the incentives to game the system. Three policies that would help stop the gaming are:

- Equalize tax rates between foreign and domestic profits.

- Codify strong anti-inversion measures to prevent companies from falsely claiming foreign residence.

- Require multinationals to publicly report basic financial information on a country-by-country basis.

For more information, please contact Clark Gascoigne at cgascoigne@thefactcoalition.org.

Footnotes:

- Congressional Budget Office, “The Budget and Economic Outlook: 2018 to 2028,” April 9, 2018. Accessible at https://www.cbo.gov/publication/53651.

- Businesses for Responsible Tax Reform, “POLL: Tax Law Won’t Help Small Businesses Grow,” March 1, 2018. Accessible at https://docs.wixstatic.com/ugd/4a8609_a801668b62ff4d9bacfe8b9fadacb995.pdf.

- Small Business Majority, “Small Business Owners Want Fair Tax System Over Tax Cuts,” October 26, 2017. Accessible at http://smallbusinessmajority.org/our-research/taxes-budget-economy/small-business-owners-want-fair-tax-system-over-tax-cuts.