“Just the FACTs” is a round-up of news stories and information regarding efforts to combat corrupt financial practices, including offshore tax haven abuses, corporate secrecy, and money laundering through the financial system.

Send feedback or items for future newsletters to Thomas Georges at tgeorges@thefactcoalition.org

Here is the State of Play

Treasury Secretary Yellen Champions Upcoming U.S. Anti-Money Laundering Initiatives at International Summit

In remarks made at the onset of the second Summit for Democracy last week, Treasury Secretary Janet Yellen noted both substantial domestic progress on anti-money laundering policy, and areas in which Treasury plans to take action in the coming months and years. Yellen specifically stressed the importance of completing the implementation of the U.S. beneficial ownership registry established by the landmark Corporate Transparency Act (CTA), saying that “Unmasking shell corporations is the single most significant thing we can do to make our financial system inhospitable to corrupt actors.”

U.S. Commits to Verification for Beneficial Ownership Data, in Concert with 20 Nations

Yellen’s remarks were accompanied by the announcement of a number of new commitments on beneficial ownership transparency, signed by the U.S. and 20 other nations. Chief among these commitments was a promise by the Administration to develop “appropriate verification measures” for the beneficial ownership information (BOI) database to be established under the CTA. Effective verification for reported BOI has been characterized as perhaps the most important step that Treasury can take towards ensuring that the database is “highly useful” to all authorized users, as required by the law’s statute.

Verification – among other issues including unobstructed access for State, local, and Tribal authorities to collected BOI information – was also flagged as key to effective implementation of the CTA in a recent op-ed by sitting U.S. Senator and longtime financial transparency advocate Sheldon Whitehouse.

Treasury Reiterates Plans to Take on Professional Enablers of Corruption

In her remarks, Secretary Yellen also highlighted upcoming steps to tackle money laundering through U.S. commercial and residential real estate markets, and future action to address the money laundering and illicit finance risks in the massive and opaque U.S. private investment sector. An accompanying White House fact sheet also highlighted its future intent to extend AML obligations to lawyers and accountants, though such steps may require collaboration with Congress.

While Yellen did not include specifics on Treasury’s plans to address money laundering through U.S. real estate and private investment markets, the Department’s regulatory agenda indicates that a Notice of Proposed Rulemaking (NPRM) on real estate will be released this month.

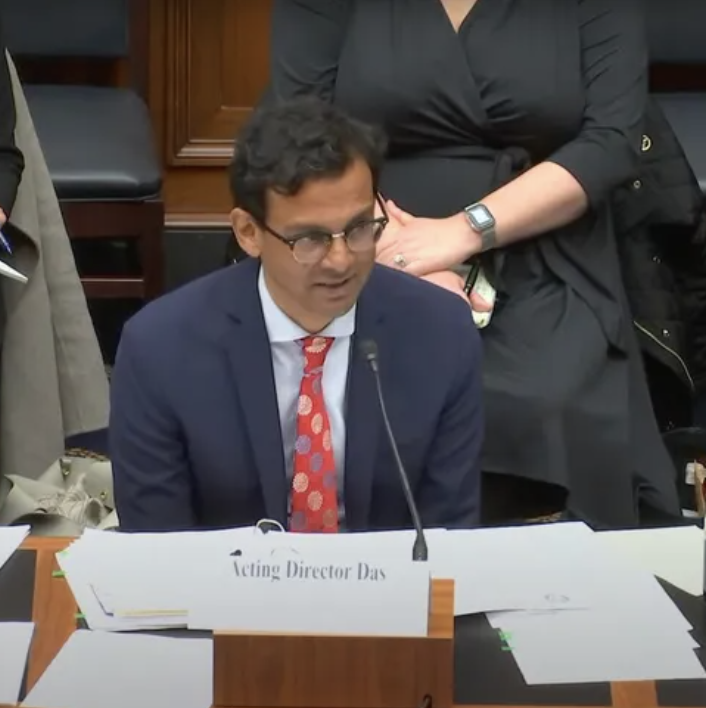

FinCEN to Revise, Reissue Widely Criticized Beneficial Ownership Reporting Form

Treasury’s Financial Crimes Enforcement Network (FinCEN) will issue a revised version of an ownership information reporting form that drew widespread criticism from lawmakers and transparency advocates “as soon as possible,” according to FinCEN chief Him Das.

The form in question – an essential document that will be used to collect information on the true, “beneficial” owners of anonymous companies in accordance with the Corporate Transparency Act – would have allowed filers to answer “Unknown” or “Unable to Obtain” with regards to major categories of statutorily required information, including a given owner’s name, address, and unique identifying number.

As FACT and others have argued, the presence of these options on a final form would effectively render reporting optional under the CTA, gutting one of the most transformative pieces of anti-money laundering legislation in decades.

These concerns were echoed by a bipartisan, bicameral group of 12 lawmakers on Tuesday – which included Financial Services Chairman McHenry (R-NC), Ranking Member Waters (D-CA), Chairman Brown (D-OH), and Sen. Whitehouse (D-RI) – in a letter calling upon Treasury to “craft an updated form consistent with current law,” and “strike the form’s options for ‘Unable to identify…unable to attain,’ and ‘Unknown…unable to obtain.’” Sen. Whitehouse reiterated his fears about the CTA’s implementation, including the intake form, in a recent Newsweek op-ed.

While FinCEN has now said that it will reissue the form, a Treasury spokeswoman was only able to say that upcoming changes “will make clear companies must submit complete and accurate information about their owners,” rather than directly confirm that these fields will ultimately be removed. FACT will continue to advocate for these fields’ removal, and more broadly for the full and faithful implementation of the CTA through upcoming rulemakings.

Latest from FACT

Global civil society organizations collectively representing more than 100 groups sent a letter to Treasury last week calling for the Biden Administration to demonstrate leadership on anti-corruption by advancing meaningful domestic anti-money laundering and transparency reforms around beneficial ownership, real estate, and private investment.

Signatories of the letter include leading regional anti-corruption coalitions, including the Asian Peoples’ Movement on Debt and Development, the Financial Transparency Coalition, the Latin American Network on Economic and Social Justice (LATINDADD), and Tax Justice Network Africa, alongside 32 other organizations spanning Africa, Asia, the Americas, and Europe.

FACT in the News

Published In: The US must safeguard democracy by combatting corruption

Read FACT executive director Ian Gary’s new op-ed for The Hill on the need for the Biden Administration to implement effective anti-money laundering reforms to fulfill its broader commitments on countering corruption at home and abroad.

“To be a credible leader and partner, the U.S. must act with urgency to clean up the dirty money flowing into our financial system.”

Quoted In: US makes corporate transparency commitment with 20 nations

FACT executive director Ian Gary was quoted in coverage of new beneficial ownership commitments made by the Biden Administration and 20 other countries by the Associated Press’ Fatima Hussein.

In addition to ongoing efforts to implement the Corporate Transparency Act, Gary noted the need for the Administration to “put in place new regulations to tackle the scourge of money laundering in the $50 trillion U.S. real estate sector.”

Quoted In: FinCEN Issues First Guidance On Beneficial Ownership

FACT government affairs director Erica Hanichak was quoted extensively in Kevin Pinner’s coverage of beneficial ownership guidance recently issued by FinCEN for Law360.

“Hanichak said the guidance released Friday was a good first step to let businesses know about their reporting obligations, but she said she hopes the agency will offer more in-depth guidance in the future covering topics like how entities with multiple layers that certain U.S. states facilitate will be affected.”

FACT’s Erica Hanichak was also quoted by the OCCRP’s Henry Pope on the role of certain American professionals in enabling the flow of dirty money into the U.S. financial system.

“While the U.S. has a strong anti-money laundering framework, it has Swiss cheese-style holes in critical sectors that allow these illicit funds to flow in,” Hanichak said… “The U.S. is behind its allies in holding accountable the enablers of corruption,” such as lawyers who “act as a gateway to the U.S. financial system for the world’s criminal and corrupt.”

Recent and Upcoming Events

Watch: Anti-Corruption as a Cornerstone of a Fair, Accountable, and Democratic Economy

Secretary Yellen’s remarks at the Summit for Democracy were followed by a panel discussion on the centrality of countering illicit finance to the Administration’s broader anti-corruption agenda. Global Financial Integrity’s Lakshmi Kumar was joined on the panel by other prestigious experts representing the Financial Action Task Force, the International Monetary Fund, and the U.S. Treasury Department, among others.

During the panel, Kumar repeatedly stressed the importance of closing existing loopholes that exempt lawyers, money managers, and other U.S. professional service providers from anti-money laundering responsibilities. “If the idea is that we want to target the very heart of what makes the illicit financial system work,” said Kumar, “you have to target the gatekeepers.”

About the FACT Coalition