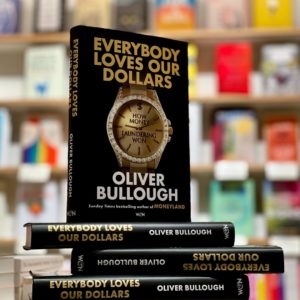

FACT Book Talk: Everybody Loves Our Dollars – How Money Laundering Won with Author Oliver Bullough

RSVP now for FACT’s virtual book talk with Oliver Bullough, author of the new book “Everybody Loves Our Dollars – How Money Laundering Won” on February 26 from 12-1 p.m.