FACT Submits Statement for Key FinCEN Oversight Hearing

FACT’s statement to House Financial Services outlines priorities for implementing beneficial ownership reform and strengthening anti-money laundering rules

FACT’s statement to House Financial Services outlines priorities for implementing beneficial ownership reform and strengthening anti-money laundering rules

Requiring private fund advisers to conduct and report basic customer due diligence is key for defending U.S. financial markets from bad and corrupt actors.

Inadequate funding for the U.S. Financial Crimes Enforcement Network (FinCEN) and the Office of Terrorism and Financial Intelligence (TFI) jeopardizes the enforcement of new U.S. sanctions in light of President Putin’s unlawful invasion of Ukraine.

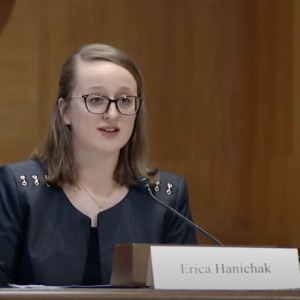

FACT Government Affairs Director Erica Hanichak spoke before the Senate Caucus on International Narcotics Control on ways legislators can deny drug traffickers and the corrupt officials they work with access to the U.S. financial system.

WASHINGTON, DC – In a comment letter submitted yesterday, the FACT Coalition welcomed action by the Treasury Department’s Financial Crimes Enforcement Network (FinCEN) to bring the U.S. real estate sector under the purview of federal anti-money laundering safeguards. The FACT Coalition offered guidance on how FinCEN should craft a rulemaking that would introduce permanent, nationwide standards to address illicit financial risks in the sector.

Section 163(n) would protect the U.S. tax base by ending the practice in which multinational corporations take excessive interest deductions against U.S. taxable income that do not reflect commensurate investment in U.S. markets