U.S. Top Jurisdiction Used by Environmental Criminals to Hide Dirty Money, New Report Finds

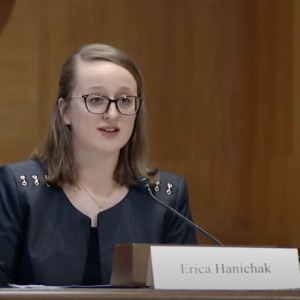

A new report by the FACT Coalition finds that the U.S. is the most common foreign destination for the products and proceeds of environmental crimes committed in the Amazon region.