Illegal Gold Mining Has Become a Crisis Too Large for the U.S. to Ignore

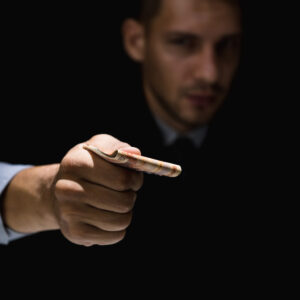

FACT’s latest report examines the devastating effects of illegal gold mining in Latin America, with a focus on how the U.S. financial system facilitates the laundering of illicit gold profits.