An earlier version of this article was posted in ITEP’s Just Taxes Blog.

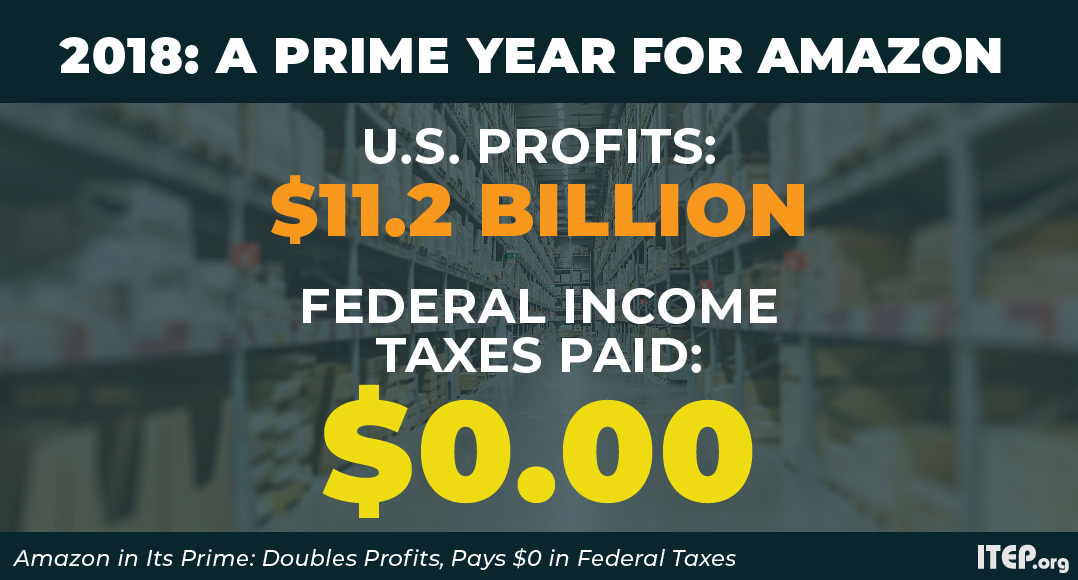

Amazon, the ubiquitous purveyor of two-day delivery of just about everything, nearly doubled its profits to $11.2 billion in 2018 from $5.6 billion the previous year and, once again, didn’t pay a single cent of federal income taxes.

The company’s newest corporate filing reveals that, far from paying the statutory 21 percent income tax rate on its U.S. income in 2018, Amazon reported a federal income tax rebate of $129 million. For those who don’t have a pocket calculator handy, that works out to a tax rate of negative 1 percent. The fine print of Amazon’s income tax disclosure shows that this achievement is partly due to various unspecified “tax credits” as well as a tax break for executive stock options.

This isn’t the first year that the cyber-retailing giant has avoided federal taxes. Last year, the company paid no federal corporate income taxes on $5.6 billion in U.S. income.

ITEP has examined the tax-paying habits of corporations for nearly 40 years and has long advocated for closing loopholes and special breaks that allow many profitable corporations to pay zero or single-digit effective tax rates. When Congress in 2017 enacted the Tax Cuts and Jobs Act and substantially cut the statutory corporate tax rate from 35 percent to 21 percent, proponents claimed the rate cut would incentivize better corporate citizenship. However, the tax law failed to broaden the tax base or close a slew of tax loopholes that allow profitable companies to routinely avoid paying federal and state income taxes on almost half of their profits.

In fact, the Trump Administration and its congressional allies included lavish new giveaways such as immediate expensing of capital investments. Multiple analysts scored the tax law as a huge revenue loser, giving away far more to big corporations in rate cuts than it takes in loophole-closers.

Amazon is no stranger to tax controversies. Last year the company, in a staggering act of hubris, engaged in a year-long aggressive push for huge new relocation subsidies for its “HQ2” headquarters. A year later, Amazon appears to have won its two-front battle against fair taxes by continuing to altogether avoid federal taxes and obtaining lucrative packages of local tax breaks for not one but two new HQ2 locations, in New York and Virginia as well breaks for an operations center in Nashville, Tenn.

To the credit of local activists, Amazon has had its feet held to the fire for its efforts to pillage local tax bases. Last week Amazon’s leadership ran a gauntlet of public opposition in New York over the scope of the tax giveaways the company has been promised. But allies in Congress have, so far, shown little interest in answering the tough questions about why their new corporate tax law can’t lay a glove on one of the most valuable and profitable corporations in the world. And while the president himself has criticized Amazon for its tax avoidance in the past, the administration has so far displayed no awareness that its own tax package appears to have made the company’s corporate tax avoidance even more rampant than before.

It’s too soon to know whether this new revelation, following hard on the heels of Netflix’s similar announcement last week, means that the floodgates have opened for a wave of Fortune 500 corporate tax avoidance: we’ll have a better sense of that a month from now, when most big multinationals will have released their financial reports for 2018, the first full year of the new Trump corporate tax law. But these initial findings appear to confirm the view that last year’s tax law was a gigantic missed opportunity for true corporate tax reform.

—

Matthew Gardner is a Senior Fellow at the Institute on Taxation and Economic Policy.