An earlier version of this article was posted on the Project on Government Oversight (POGO) Website.

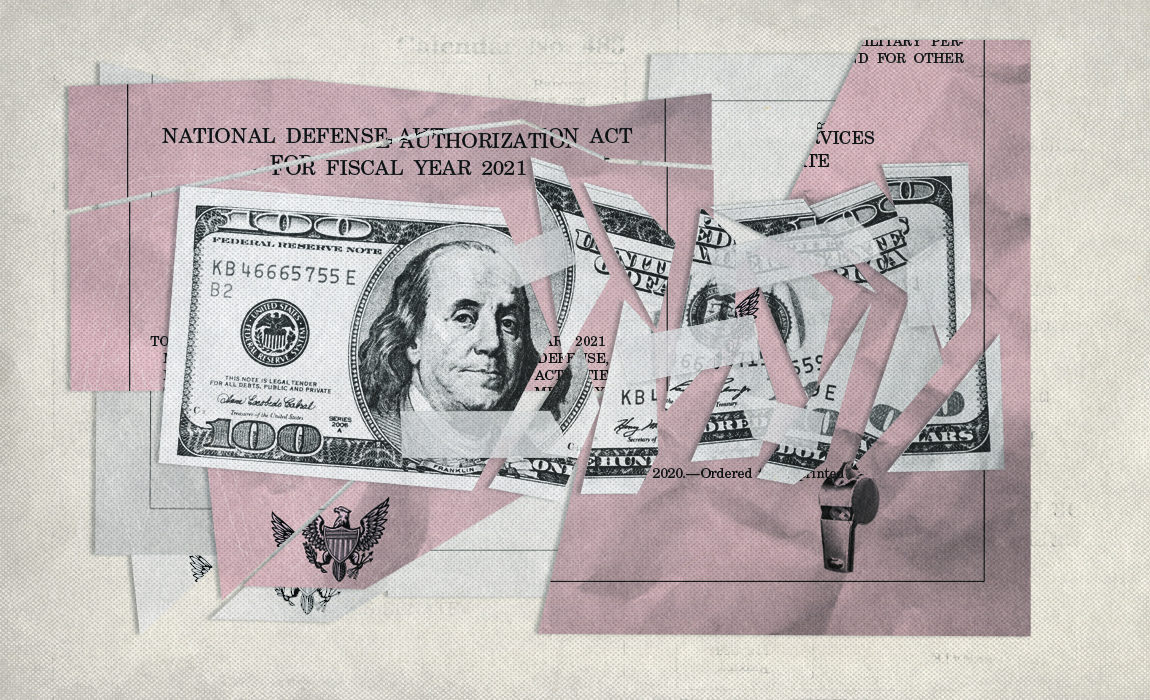

As 2021 began, Congress passed two landmark laws that will help improve the transparency of federal contractors and combat the use of anonymous shell companies for money laundering. Enacted as part of the mammoth $740 billion National Defense Authorization Act (NDAA), the Corporate Transparency Act and Section 885 of the defense bill mark significant steps forward in providing much-needed additional transparency of companies’ real owners, known as beneficial owners. While the Corporate Transparency Act—which requires most U.S. companies to register their true owners with the federal government—has been widely covered, Section 885’s measures targeting beneficial ownership transparency for federal contractors have received less attention but are complementary and significant in their own right.

Until now, anonymously incorporating a company in the United States has been easier than getting a library card in all 50 states.

Beneficial ownership refers to the person who really owns, controls, and financially benefits from an entity at the point of a company’s formation and throughout the company’s existence. Until now, anonymously incorporating a company in the United States has been easier than getting a library card in all 50 states.

As a result, anonymous shell companies have been able to facilitate a wide variety of illicit activities that directly harm U.S. domestic and foreign policy interests: from public corruption to government and defense contract fraud, organized crime, intellectual property theft, money laundering, terrorism financing, and the opioid crisis. Requiring companies to report their beneficial owners will help prevent the exploitation of U.S.-registered companies by rogue nations, terrorists, drug and human traffickers, weapons smugglers, and other criminal operations.

The Corporate Transparency Act

The Corporate Transparency Act, or Section 6401 of the NDAA, is a critical component of the defense bill’s new beneficial ownership regime, requiring companies formed in the U.S. to disclose information about their beneficial owners to law enforcement. It also includes a set of new whistleblower protection measures to encourage individuals to report wrongdoing. The first version of the Corporate Transparency Act was introduced a decade ago by Representative Carolyn Maloney (D-NY).

The Treasury Department’s Financial Crimes Enforcement Network, or FinCEN, will collect and house companies’ beneficial ownership information. The agency is uniquely qualified to oversee beneficial ownership information, as its mission is to safeguard the financial system from illicit use and to combat money laundering and promote national security through the collection, analysis, and dissemination of financial intelligence to authorities for strategic use. The information will not be publicly available, but local, state, and federal law enforcement agencies will be able to access it to support ongoing investigations. In addition, allies overseas could in theory access the information through appropriate protocols such as mutual legal assistance treaties and other agreements.

Unfortunately, not all businesses will have to file their beneficial ownership information with the Treasury. To garner the political support necessary to get the bill passed, lawmakers added certain exceptions. Entities that file redundant reports with other federal agencies are not required to file. For example, publicly traded firms that file similar information with the Securities and Exchange Commission (SEC) will not have to file beneficial ownership information with Treasury. Nor would certain private equity-owned companies or larger private companies that have clear U.S.-based operations.

The Corporate Transparency Act creates a new gold standard in U.S. law to protect whistleblowers challenging financial misconduct.

The Corporate Transparency Act creates a new gold standard in U.S. law to protect whistleblowers challenging financial misconduct. The law not only protects disclosures of money laundering, but the exposure of illegality that violates any law, rule, or regulation enforced by the Treasury Department. Whistleblowers will have up to six years to challenge retaliation after it occurs, and the law includes best-practice provisions for confidentiality, legal burdens of proof, and shields against gag orders. In addition, the law’s whistleblower protections for those reporting Bank Secrecy Act violations include an incentive program to encourage whistleblowers to come forward and report misconduct and malfeasance when they see it. The new Anti-Money Laundering and Counter-Terrorism Financing Fund can pay financial rewards to whistleblowers when the government is able to recuperate money based on the whistleblower’s report. While awards can be issued up to 30 percent of the total recovered funds, Congress should impose a minimum award threshold to fully empower whistleblowers to come forward. Not doing so, gives agencies the discretion to award whistleblowers smaller amounts.

Section 885: Requiring federal contract awardees to disclose their beneficial owners publicly

Section 885 of the defense bill includes a provision that will require all companies receiving federal contracts in excess of $500,000 to publicly disclose their beneficial ownership information. This is critical because investigations into waste, fraud, and abuse in government spending have routinely found companies with anonymous or opaque ownership structures to be dangerous facilitators of corruption and misconduct.

For example, anonymous shell companies have been used to steal money from the federal government and harm our national security. A November 2019 report by the Government Accountability Office found that the Defense Department lost at least $875 million to fraudulent contractors between 2012 and 2018. The report also found that shell companies were used to circumvent prohibitions on the use of foreign-based manufacturers, including one case in which it was discovered that faulty parts that caused the grounding of 47 combat aircraft were secretly made abroad rather than in the United States as was required by the contract. The report also noted that Defense Department officials recognize that secret company ownership of contractors could allow “adversarial foreign governments” to conduct “sabotage or surveillance.”

Anonymous shell companies have been used to steal money from the federal government and harm our national security.

Section 885 also requires the General Services Administration to update the Federal Awardee Performance and Integrity Information System (FAPIIS), which was created over a decade ago to track contractor misconduct and performance. The Project On Government Oversight (POGO) had long called for the government to create such a system. In fact, POGO created the first federal contractor misconduct database in 2002. Eventually, in 2008, Congress created FAPIIS—modeled on POGO’s database—and has progressively improved the database over the years to include more meaningful information, and to make it public. Currently, the database discloses a company’s parent, subsidiaries, successor entity, immediate owner, and highest owner. With this new law, companies will be required to submit their beneficial owners to the government when they bid on any contract.

Comparing the Two Provisions

While the Corporate Transparency Act includes several exemptions, such as those for large companies and for companies that already report similar ownership information to federal agencies, these companies are not exempt from reporting under Section 885. First and foremost, the FAPIIS database is already publicly available and, per Section 885, will soon include beneficial ownership information. Second, Section 885 has fewer loopholes, as all companies that wish to obtain federal contracts from the federal government in excess of $500,000 would be required to disclose. Furthermore, the two provisions use different definitions of beneficial ownership, and it’s unclear what the implications will be. While the Corporate Transparency Act requires reporting on beneficial owners with either substantial control or a 25% or higher ownership stake, Section 885 uses the beneficial ownership definition from last year’s defense bill, which uses the SEC’s definition; the SEC defines a beneficial owner as someone who has voting power or the power to direct a vote.

The inclusion of the two beneficial ownership provisions in this year’s defense bill is an important step in protecting taxpayers while strengthening our national security. Ensuring those who wish to bid on federal contracts truly live and reside in the United States will help guarantee that those federal funds are in fact benefiting U.S. taxpayers and businesses. Furthermore, while there are certain improvements that could be made to eliminate some exemptions of the Corporate Transparency Act, the law is a crucial advancement in the fight against corruption and money laundering.

—

Tim Stretton is a policy analyst with the Project on Government Oversight with expertise in the federal reserve, financial services, public lands, and oil and gas royalties.