“Just the FACTs” is a round-up of news stories and information regarding efforts to combat corrupt financial practices, including offshore tax haven abuses, corporate secrecy, and money laundering through the financial system.

Send feedback or items for future newsletters to Patricia Ainembabazi at painembabazi@thefactcoalition.org

Hey folks,

We know the newsletter is a little late this week, but we’ve got some big news:

FACT is hiring for the position of Policy Director! You can find more info below, but if you are driven, detail-oriented, and passionate about financial transparency and international tax justice, then apply to join our dynamic team and coalition of more than 100 organizations today!

We also have a great panel discussion coming up this Friday, hosted in collaboration with our friends at GATJ and the Nawi Collective. Read more and register here for Advancing the Fight for Gender Justice through Tax Justice: Perspectives from Africa and the U.S., featuring an incredible group of speakers and hosted both in-person at the Open Gov Hub and online!

Now let’s get into the news from the past two weeks…

Here is the State of Play

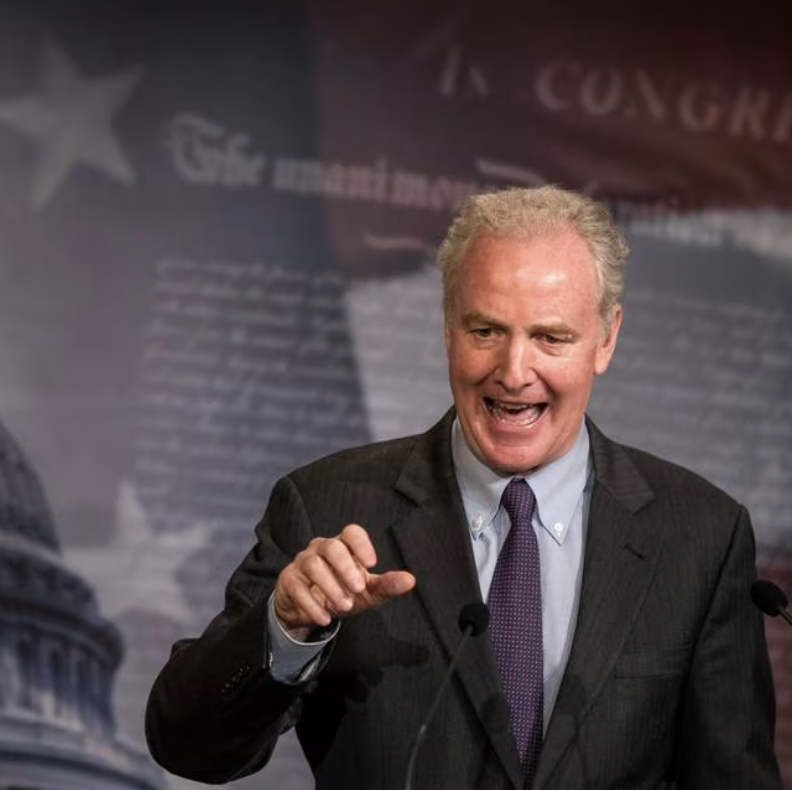

Tax Transparency – Bill Mandating Public Country-by-Country Reporting Reintroduced in Senate

Senator Chris Van Hollen and 10 of his colleagues reintroduced the FACT-endorsed Disclosure of Tax Havens and Offshoring Act in the Senate Thursday, which would mandate public country-by-country reporting (PCbCR) of tax and operations data by multinational corporations.

FACT has been at the forefront of efforts to encourage the Securities and Exchange Commission (SEC) to use its existing authority to require PCbCR for large multinationals. If passed, the Disclosure of Tax Havens and Offshoring Act would rapidly advance the timetable for these much-needed reforms, providing critical data to legislators, investigators, and journalists looking to address ever-worsening patterns of tax-dodging by the world’s largest companies.

Investors, likewise, have been another important constituency of support for PCbCR in recent years. With widespread adoption of the OECD Global Tax Agreement’s 15% global minimum corporate tax gaining steam, investors are currently left unable to determine the extent to which many multinationals – and their bottom lines – will be impacted by these sweeping reforms.

While more and more companies are voluntarily publishing country-by-country data on the international level, only two major U.S.-headquartered multinationals currently engage in PCbCR.

Last October, Australia became the first major jurisdiction to propose a full PCbCR regime in line with international standards, while the EU adopted an incomplete reporting regime in late 2021. Expected to be enacted into law later this year, Australia’s mandate will likely capture a subset of U.S. multinationals doing business in the country, raising fears of uneven reporting standards and information asymmetry between jurisdictions. Without a full PCbCR regime of its own, the U.S. is at risk of falling behind global trends towards greater tax transparency, leaving both policymakers and investors in the dark with regards to this critical decision-making data.

Money Laundering Watchdog Suspends Russia as Ukraine War Enters Second Year

In an unprecedented rebuke, the global money laundering watchdog FATF suspended Russia on the one year anniversary of the commencement of President Vladimir Putin’s invasion of Ukraine.

Following FATF’s decision, Russia remains a member of the organization, but will not be allowed to attend convenings or access key internal documents. Russia will remain a member of the FATF Global Network through the Eurasian Group on Combating Money Laundering.

Despite efforts to impose crippling sanctions by Kremlin-affiliated oligarchs and officials by the Biden Administration and its allies since the invasion of Ukraine, dirty money continues to flow from Moscow into the U.S. financial system through various money laundering mechanisms and legal loopholes. The largely unregulated private investment and real estate sectors have proven particularly vulnerable, enabling high-profile oligarchs to smuggle staggering sums into the U.S.

FACT has repeatedly called for domestic anti-money laundering (AML) reforms to address these shortcomings. Foremost among these reforms include upcoming rulemakings by the Treasury’s Financial Crimes Enforcement Network (FinCEN) to finalize faithful implementation of the Corporate Transparency Act (CTA), and strengthen AML regulations on private equity and real estate markets. While the CTA is set to take effect on January 1, 2024, and Treasury has announced that it will release a draft real estate rule in April, no timeline yet exists for a rulemaking on private equity.

Latest from FACT

Job Opening: FACT Seeks a Full-time, Dynamic, and Experienced Policy Director to help the Coalition Achieve its Policy Objectives

The FACT Coalition is looking for an experienced, driven Policy Director to lead and manage the Coalition secretariat’s legislative and policy analysis, as well as help set and actualize FACT’s research and regulatory comment agendas. Offering competitive pay and benefits, remote work options are available for this position.

Press Release: FACT Welcomes Reintroduction of Legislation Mandating Public Country-by-Country Reporting from Multinationals

FACT welcomed the reintroduction of the Disclosure of Tax Havens and Offshoring Act by Senator Chris Van Hollen and his colleagues Thursday. Citing a cascade of recent domestic and international momentum for PCbCR among investors, policymakers, and business groups, FACT executive director Ian Gary noted that “…the question is now not whether large corporations are going to have to start reporting this information, but when.”

Blog: Biden Support for Ukraine Must Include Tackling Financial Secrecy at Home

In her latest blog, FACT government affairs director Erica Hanichak argues that the Biden Administration must make substantive progress on financial secrecy and anti-money laundering reform at home in order to fulfill its promise of “unwavering support” for Ukraine.

“Every time a sanctioned Russian oligarch has new U.S. assets frozen, a more sinister truth reveals itself: the United States obstructs its own economic sanction regimes by failing to simultaneously tackle the same secrecy systems that draw and allow these oligarchs to invest in the rule-of-law jurisdictions like the U.S. in the first place.”

FACT in the News

Cited In: Treasury’s latest Hill headache

FACT was cited in coverage of FinCEN’s rollout of the second draft rule to implement the Corporate Transparency Act for Politico’s Morning Money newsletter. Citing the requirement that state, local, and tribal authorities acquire a court order to access the beneficial ownership information (BOI) registry established by the CTA as one example among many, FACT’s former policy director Ryan Gurule noted that the rule “creates substantive and procedural hurdles that didn’t exist in the statute and that threaten to undermine the purpose of the directory in the first place.”

Quoted In: FinCEN Blasted Over Beneficial Ownership Registry Plan

FACT executive director Ian Gary was cited by Law360 in coverage of widespread concern from civil society, watchdog, banking, and business groups over weaknesses in FinCEN’s second rule to implement the CTA.

“(This draft rule) has the potential to unnecessarily complicate access to the beneficial ownership database established under the CTA to a degree that could seriously impact the efficacy of the law as a whole.”

Recent and Upcoming Events

March 6: Tax Justice for Women’s Rights 2023 Campaign Launch Event

The FACT Coalition joined Coalition-member the Global Alliance for Tax Justice (GATJ) for an event launching the 2023 Global Days of Action (GDOA) on Tax Justice for Women’s Rights, running from March 6 through the 17th.

FACT policy fellow Sofia Gonzalez appeared alongside representatives from a number of civil society, economic and gender justice groups on a virtual panel for the GDOA launch event at 8am EST. A recording of the event can be found here.

March 10: Advancing the Fight for Gender Justice through Tax Justice: Perspectives from Africa and the U.S.

Join FACT, GATJ, and the Nawi Collective for a hybrid, in-person panel discussion covering international and domestic perspectives on the intersection of tax policy and gender equity. Panelists for this timely discussion include GAJT’s Âurea Mouzinho, Crystal Simeoni of the Nawi Collective, and Amy Matsui of the National Women’s Law Center.

Hosted at the Open Gov Hub and online via Zoom, lunch will be provided for in-person attendees.

March 20: Comments Due – Forms for Submitting Beneficial Ownership Information

FinCEN is soliciting feedback on the forms that reporting companies will use to submit their beneficial ownership information to FinCEN, in accordance with the first final rule implementing the Corporate Transparency Act (CTA). FACT has called on the Treasury Department to withdraw and reissue the form.

“Allowing reporting companies to simply declare that they do not know information required under the CTA has no basis in the law and conflicts with the CTA’s plain meaning.” Comments are due March 20.

March 29-30: Second Summit for Democracy

The mixed-format Second Summit for Democracy will bring together government, civil society, and private sector leaders from around the globe to reflect on progress made during the past “year of action,” and to establish new anti-corruption, pro-democracy, and accountability commitments.

About the FACT Coalition