This Op-Ed was originally published through Bloomberg Tax on Aug. 30, 2022.

http://www.bloombergindustry.com/

The original publication can be viewed here: Investors Fly Blind Without Public Country-by-Country Reports

Global tax and geopolitical developments are rattling investors. Without important changes in required financial disclosures for public country-by-country reporting (PCbCR) of key operational, revenue and tax related information, investors are essentially flying blind into potential financial storms.

As a new report from our broad financial-transparency focused coalition shows, greater tax and financial transparency on a country-by-country basis is a material concern for investors.

Imagine the risks faced by multinational companies doing business in Taiwan, which is facing threatening moves by China. Or the risks companies operating in Russia and Ukraine faced prior to Russia’s unprovoked invasion and the fallout from those devastating events. Current reporting requirements give investors scant information on how exposed they might be to geopolitical risks around the world.

Major changes are also coming to how US and foreign listed multinational corporations are taxed. Whether reporting regarding the corporate alternative minimum tax in the Inflation Reduction Act or global implementation of the OECD tax agreement, the public disclosure regime is simply not up to the task of informing investors about the tax enforcement and reform risks they face.

Recently, we’ve seen eye-popping adjustment wins for tax authorities against multinational companies around the world. In June, McDonald’s Corp. agreed to pay a jumbo-sized $1.3 billion in fines and back taxes to French authorities. In 2020, the IRS won a transfer pricing case against Coca-Cola Co., resulting in a $3 billion tax bill for the 2007-2009 period, and applying the ruling to Coke’s practices through 2020 would potentially result in $12 billion in additional taxes owed.

Pick a major multinational company and look at the 10-K and other reports filed with the Securities and Exchange Commission. There is insufficient detail to assess tax and geopolitical risks, with tax information and results from global operations typically lumped into aggregate “domestic” and “international” totals.

Without PCbCR, investors have very little knowledge about the tax strategies of companies they own and the degree to which they may be engaging in risky tax behavior to pad their bottom lines. Likewise, investors cannot assess how exposed they may be to operations in geopolitically risky countries. Lacking this information, investors may make inefficient capital allocation decisions, which could result in significant financial loses and increased market volatility.

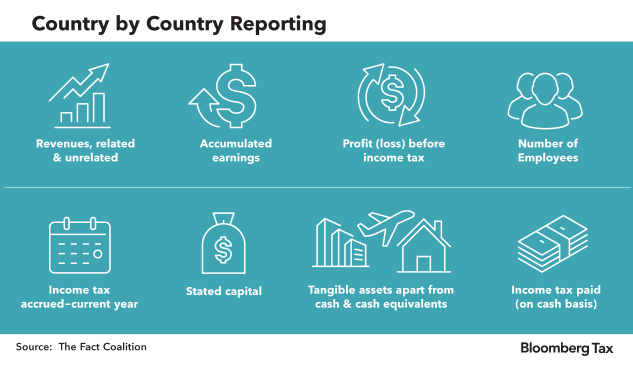

Public country-by-country reports would provide valuable insights to investors and investor analysts, including information on corporate income taxes paid, tangible assets, profits and loss before tax, and the number of employees per jurisdiction. Notably, large multinational companies are already sharing this information with the IRS and other tax authorities, so compliance costs for any new public reporting requirements would be minimal.

Our FACT Coalition report uses voluntary McDonald’s filings regarding its Russian and Ukrainian operations to show why PCbCR is so essential. Supplemental filings in February and March by McDonald’s provided information at a granular level not normally provided to investors. This information can be seen as acting as a proxy for the kind of information PCbCR can, and should, provide to investors on a regular basis.

The information provided only in connection with the invasion would allow a reasonable investor to potentially price greater risk into McDonald’s valuation. While it is likely that McDonald’s had this kind of information available—and likely regularly provides it to the IRS—our report notes “investors are denied access to these numbers on a regular basis [under current SEC and public accounting rules],” preventing investors from pricing in geopolitical risks before catastrophic events occur.

Thankfully, the movement for greater tax transparency is gaining steam. Investors worth trillions of dollars in assets under management are at the forefront of the movement for greater financial transparency from multinational corporations.

The gold standard for PCbCR is the Global Reporting Initiative’s tax standard. Developed after extensive consultations with companies, investors, and civil society groups, the tax standard is a voluntary reporting standard that has been used, in some form, by leading companies such as Vodafone, Shell, BHP, Philips, and others. While these companies should be commended for their leadership role in advancing public financial disclosures, the tax standard’s voluntary nature means information is often inconsistent, creating information asymmetries for investors across voluntary filers (as well as across those who choose to file at all, and those who do not).

Mandatory disclosure regimes would provide more uniform and meaningful information to investors. Last year, the European Union became the first jurisdiction to put in place a PCbCR reporting regime. While the geographic scope is limited, large multinational companies (above 750 million euros in consolidated group revenue) will be required to report after June 2024. This EU regime builds on tax disclosure requirements already in place for the banking sector and extractive industries; notably, some US-headquartered companies could be required to disclose if they meet the qualifying requirements. Australia’s new Labor Party government has also committed to putting in place a mandatory PCbCR reporting regime and this month launched a public consultation to solicit input.

What about action in the US, home to the world’s largest capital markets and the world’s biggest economy? Last year, backed by investors worth trillions, the House of Representatives passed the Disclosure of Tax Havens and Offshoring Act, which would require the SEC to put in place a PCbCR rule. The Senate is considering similar legislation and, just last month, Senate appropriators backed calls for greater transparency from investors in report language indicating the SEC should “consider promulgating requirements for public companies to disclose basic financial information on a country-by-country basis.”

Patchwork PCbCR efforts are not enough, and the need for mandatory, consistent, and comprehensive regimes is clear. The SEC must take a leadership role and address the chasm between what companies know and what they are publicly disclosing to investors. The SEC has clear statutory authority to launch a new rulemaking process to require PCbCR, and it should use this authority.

If the SEC fails to act quickly, it will exacerbate market volatility and continue to expose investors needlessly to material risks.

This article does not necessarily reflect the opinion of The Bureau of National Affairs, Inc., the publisher of Bloomberg Law and Bloomberg Tax, or its owners.

Reproduced with permission from Copyright 2022 The Bureau of National Affairs, Inc. (800-372-1033) www.bloombergindustry.com.