Apple’s EU Ruling Underscores Need to Change Laws to Combat Tax Avoidance

The FACT Coalition issued a statement on the European Union court ruling overturning a 2016 decision that found that Apple had received illegal tax breaks from Ireland.

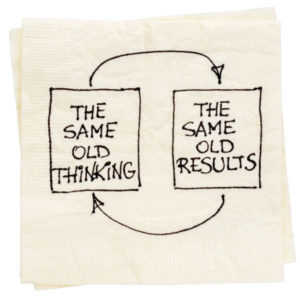

There is widespread agreement, across the political spectrum, that the gaming of the tax code by multinational corporations is a problem. When profits and jobs are shipped offshore, we not only harm the U.S. economy, we fuel a tax haven industry that drains wealth around the world. We seek to fix the problem of large, well-connected interests gaming the tax system.

The FACT Coalition issued a statement on the European Union court ruling overturning a 2016 decision that found that Apple had received illegal tax breaks from Ireland.

Sen. Durbin and Rep. Doggett’s bill provides a critical safeguard against corporate abuse at this time of national crisis.

The FACT Coalition sent a letter to Congress outlining key transparency and accountability measures to guide the ongoing policy response to COVID-19.

The FACT Coalition sent a letter to Congress opposing any offshore corporate tax giveaways in a COVID-19 emergency response package and calling for country-by-country tax transparency as a prerequisite for any potential tax breaks or bailouts.

This article was originally posted by Oxfam America. The controversial departure of its chief economist highlights the need for a coherent policy on tax and development. Last month, word got out that the World Bank’s Chief Economist Pinelopi Koujianou Goldberg was planning to leave her position after just over a year on the job. It’s the second transition …

Earlier this year, Amazon and Netflix made headlines when ITEP reported findings that these and at least 58 other companies paid no federal income taxes in 2018. One of the tax breaks they use to manage this feat is related to stock options, the subject of a new ITEP report.