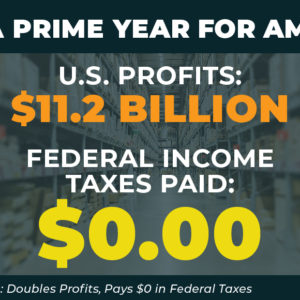

New Bill Removes Tax Incentives to Shift Profits and Operations Offshore

“No Tax Breaks for Outsourcing Act” Endorsed by 57 National Organizations, Sponsored by 80 Members of Congress

WASHINGTON, D.C. – Eighty lawmakers introduced legislation Wednesday that would equalize the tax rates for domestic businesses and multinational corporations — reducing the tax incentive to shift profits and operations overseas that were enacted under the recent tax overhaul, according to the Financial Accountability and Corporate Transparency (FACT) Coalition.