First Gambit in Tax Reform Debate a Threat to Taxpayers

A Recent Executive Order Threatens to Roll Back Safeguards against Offshore Tax Avoidance

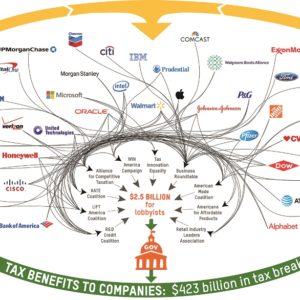

The tax reform battle in Congress is looking to be a long, hard-fought one, but the president’s recent executive order shows that there may be no need to wait to start giving huge tax breaks to corporate giants.

The executive order, signed late last month, calls on the Treasury Department to review all “significant” tax regulations issued on or after January 1, 2016. Included in this window are rules curtailing earnings stripping and corporate inversions for the purpose of tax avoidance.