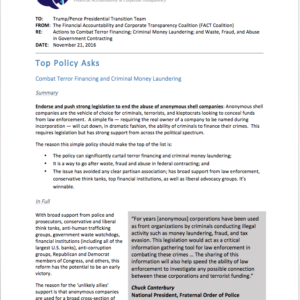

End the Travel Ban: An Alternative Proposal to Combating Terror

Ending Anonymously-Owned Companies Would Be Widely Seen as an Effective Strategy in Crippling Those Who Pose a Real Danger to the U.S.

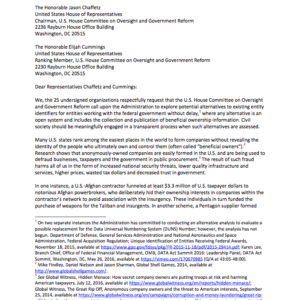

The President’s executive order banning refugees and legal immigrants from seven Muslim-majority nations has led to large protests in the U.S. In a conversation yesterday with anti-corruption advocates based in Canada and Belgium, I listened as they discussed the outrage this order has generated around the globe. The action, it appears, only reinforces the worst fears they held about the new administration.

The order is unconscionable, likely unlawful and—according to a growing list of security experts— unhelpful in protecting the nation against acts of terror. Just a few days in and the stories of harm and disruption are piling up.