“Just the FACTs” is a round-up of news stories and information regarding efforts to combat corrupt financial practices, including offshore tax haven abuses, corporate secrecy, and money laundering through the financial system.

Send feedback or items for future newsletters to Thomas Georges at tgeorges@thefactcoalition.org

Here is the State of Play

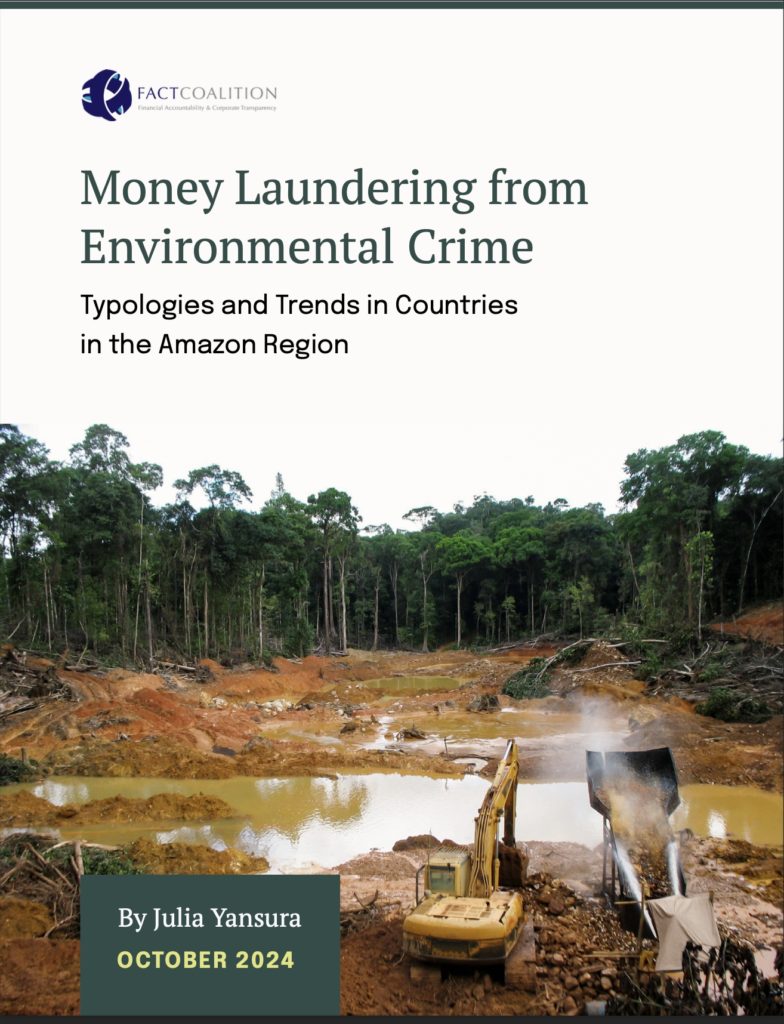

New FACT Research Bolsters Case for U.S. Action on Environmental Crimes at UN Biodiversity Conference

FACT’s latest report analyzing money laundering typologies associated with environmental crimes finds that, among 230 analyzed cases, the United States is the most common foreign destination for the products and proceeds of environmental crimes committed in countries in the Amazon region. The report, authored by FACT program director for environmental crime and illicit finance Julia Yansura, also finds that anonymous shell and front companies are the most common secrecy vehicles used to commit and conceal the proceeds of environmental crimes.

Just one week after the launch of the report, FACT joined leading civil society groups from Colombia, Peru, and Brazil for a panel discussion on illegal mining in the Amazon as a part of the sixteenth meeting of the Conference of the Parties to the UN Convention on Biological Diversity (COP16). Like many environmental crimes, illegal mining has an outsized impact on biodiversity in vulnerable ecosystems, as well as on local communities.

FACT’s joint presentation at COP16 was accompanied by the release of a new policy brief – coauthored by the Amazon Alliance for Reducing the Impacts of Gold Mining (AARIMO) in Colombia, the Igarapé Institute in Brazil, and the Observatory on Illegal Mining (OMI) in Peru – detailing seven key recommendations for governments to help mitigate the harms of illegal mining. Among other measures, the brief calls for renewed efforts to combat illicit financial flows associated with environmental crimes in the region, including through anti-money laundering reforms in “destination” countries like the United States, and through increased intergovernmental collaboration.

2024 has been a transformative year for such efforts: the U.S. anti-money laundering framework underwent crucial revisions through the launch of the nation’s first beneficial ownership registry in January, and Treasury finalized long-awaited new rules bringing anti-money laundering safeguards to domestic residential real estate and private investment markets in August. Treasury also recently advanced a major new intergovernmental initiative – the Amazon Region Initiative Against Illicit Finance – to target the proceeds of nature crimes through enhanced information exchange and technical assistance to governments in the Amazon region, in line with long-standing FACT recommendations.

Ahead of 2025 Tax Fight, FACT Calls on Congress to Protect U.S. Domestic Businesses, Jobs by Better Taxing Multinational Corporations

Last week, FACT submitted official comments to the House Ways and Means Committee’s Republican Tax Team for Global Competitiveness calling on lawmakers to help level the playing field for wholly domestic businesses and raise substantial revenues by addressing unfair tax breaks given to U.S.-based multinational corporations.

The reforms proposed in FACT’s comment would raise up to one trillion dollars in new revenue and end tax incentives for U.S. multinationals to shift jobs and profits offshore. These include measures to:

- Equalize the tax rates for foreign and domestic earnings. Currently, U.S. multinationals can get up to a 50 percent tax discount on their foreign profits, all while receiving further tax benefits from packing up their U.S. operations (and associated jobs) and moving them offshore.

- Repeal wasteful handouts for specific industries, including the Foreign-Derived Intangible Income deduction, which rewards big tech companies for making windfall profits from export sales, and the Foreign Oil And Gas Extraction Income exemption, which subsidizes U.S. companies engaged in drilling abroad.

- Adopt the Undertaxed Profits Rule, which would allow the U.S. to tax subsidiaries of foreign corporations engaged in profit shifting and other tax avoidance schemes.

- Protect American investors from tax risks by requiring greater transparency from U.S. multinational corporations.

The recommendations made in last week’s comment build upon FACT’s new policy platform for the 2025 tax debate.

Latest From FACT

FACT Environmental Crimes Newsletter: Fall 2024

Read the first edition of FACT’s new Environmental Crimes Newsletter, a biannual roundup of news stories, publications, and events featuring FACT and our allies from across the globe.

The inaugural edition of the Newsletter includes coverage of the new intergovernmental Amazon Region Initiative Against Illicit Finance, the Chiquita Brands International scandal, a new documentary film on environmental crimes committed along the Cotuhé river in the Peruvian Amazon, and more.

Comment: Financial Transparency Critical to Achievement of UN Sustainable Development Goals

FACT recently submitted official comments ahead of preparations for the United Nations’ Fourth International Conference on Financing for Development (FfD4), set to be held in Seville, Spain in July 2025.

FACT’s comments highlighted the importance of financial transparency measures to effective domestic revenue collection and financing sustainable development. In particular, FACT recommended that UN negotiators consider adopting language in support of public corporate tax reporting requirements, which would “ensure actual and immediate access” to reported information for many Global South tax authorities that are frozen out of existing information exchange networks.

Following the release of FACT’s investor petition filed on behalf of investors with $2.3 trillion in assets under management, read a new FACT sheet on the need for greater corporate tax transparency to protect investors and inform policy debates.

Read FACT executive director Ian Gary’s latest blog following his return from Ghana, where he represented FACT at a national tax conference organized by the Ministry of Finance and Oxfam in Ghana.

From the blog: “Last week, The Economist magazine said that developing countries have experienced a ‘brutal decade’ and that ‘aid is not coming to the rescue’. To turn this situation around, tax reform must be at the center of the “financing for development” agenda. Tax transparency has a key role to play to help Global South countries generate revenues to respond to the climate crisis and meet their urgent self-determined development needs.”

FACT in the News

Amazon Region Environmental Crime Investigations Often Fail to ‘Follow the Money’: Report

FACT’s new report detailing money laundering typologies associated with environmental crimes in the Amazon region was covered by The Hill’s Zack Budryk.

From the report: “Going forward, it is important to improve countries’ capacity to integrate financial investigations into their environmental crime investigation and enforcement actions. The U.S. government should support these efforts through capacity building and technical assistance to countries in the Amazon region, leveraging the existing framework of Treasury’s Amazon Region Initiative.”

Lifting the Veil on Tens of Billions in Oil Company Payments to Governments

FACT policy director Zorka Milin was quoted in Inside Climate News’ coverage of the first round of payments-to-governments disclosures by large U.S. oil and gas companies under Dodd-Frank Section 1504.

“This is kind of an instructive story of how big powerful oil interests did not want to see this reform happen, and they threw everything at it, and they won some things but didn’t carry the day,” Milin said. “I think that is something hopeful.”

From Our Allies

In Ecuador, Booming Profits in Small-Scale Gold Mining Reveal a Tainted Industry – Investigation

A months-long investigation of the activities of three small Ecuadorian mining companies by Mongabay and Codigo Vidrio suggests that exports of illegally-mined gold from the country have soared in recent years, even as criminal organizations have tightened their chokehold on artisanal gold mining operations.

Fifteen Companies Each Avoided More than $1 Billion in Taxes from a Single Trump Tax Cut

New data from FACT-member ITEP provides a glimpse into the massive revenue costs of one of the tax code’s most wasteful corporate provisions, the Foreign-Derived Intangible Income (FDII deduction, which has provided over $50 billion in tax benefits to only a handful of large U.S. multinational corporations since 2018.

Recent and Upcoming Event

Watch: Foreign Agents – A Book Talk and Panel Discussion with Casey Michel

On October 17, 2024, the FACT Coalition and Transparency International U.S. hosted a virtual book talk and panel discussion with Casey Michel, author of the new book, Foreign Agents: How American Lobbyists and Lawmakers Threaten Democracy Around the World. The discussion focused on the most important reforms U.S. policymakers can make to ensure that foreign agents – and dirty money – don’t undermine American democracy.

Watch: Revealed – The Billions Big Oil Didn’t Want You to See

Watch FACT’s recent panel with experts from Oxfam America, The One Campaign, EarthRights International, and the Natural Resource Governance Institute on the first round of payments-to-governments disclosures under Dodd-Frank Section 1504.

FACT executive director Ian Gary will be presenting at a panel on financial transparency alongside experts from Open Contracting Partnership, Open Ownership, the UNCAC Coalition, and the Stolen Asset Recovery Initiative next week at the UN FfD4 preparatory session.

The panel will touch on key reforms that enhance transparency, accountability, and inclusiveness – including beneficial ownership transparency and public procurement reform – to combat corruption and mobilize funds towards achieving the UN Sustainable Development Goals.

A link to stream this event will be provided in the coming days. Keep an eye on the web page linked above for information on how to tune in!

About the FACT Coalition