Investors, Businesses, and Policymakers Increasingly Take Steps Toward Public Country-by-Country Reporting of Tax Information

WASHINGTON, D.C. – Public disclosure of multinational corporations’ disaggregated profits and taxes is steadily progressing toward a global norm as investors, businesses, and policymakers have increasingly taken steps toward transparency, according to a new study published Tuesday by the Financial Accountability and Corporate Transparency (FACT) Coalition.

The FACT Coalition is a non-partisan alliance of more than 100 state, national, and international organizations working toward a fair tax system that addresses the challenges of a global economy and promoting policies to combat the harmful impacts of corrupt financial practices.

The FACT Coalition is a non-partisan alliance of more than 100 state, national, and international organizations working toward a fair tax system that addresses the challenges of a global economy and promoting policies to combat the harmful impacts of corrupt financial practices.

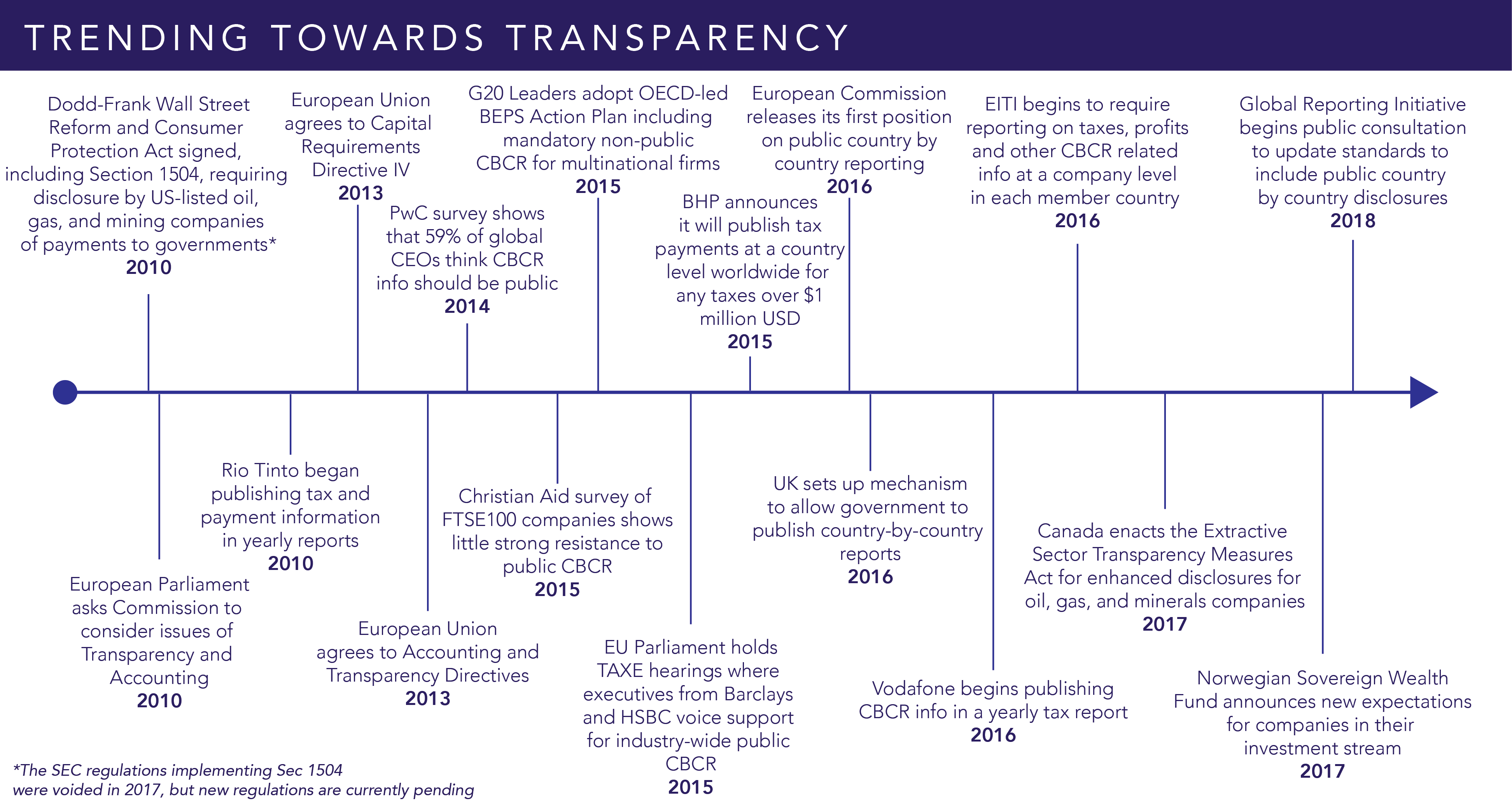

Titled “Trending Toward Transparency: The Rise of Public Country-by-Country Reporting,” the report highlights the growing list of enacted and proposed rules around the world to mandate increased disclosures that are promoted among various sectors of the investing, business, and policymaking communities.

“The rapid shift from complete secrecy to increasing transparency has been remarkable,” said Gary Kalman, executive director of the FACT Coalition. “Before the financial crisis, no one was seriously talking about disaggregated corporate tax reporting. Fast forward a decade, and 77 countries now require multinationals to file country-by-country reports privately to tax authorities; oil, gas, and mining companies in Europe, Canada, and elsewhere must disclose the information publicly; large banks in Europe also have public disclosure requirements; and the largest sustainable investment standards-setting body has proposed new tax transparency requirements that include public country-by-country reporting.”

The report notes the broad and growing array of voices supporting increased disclosure. Major investors, chief executive officers of multinational firms, standard-setting bodies, and legislators increasingly support and encourage tax transparency measures like public country-by-country reporting.

“The evidence suggests we are quickly reaching a turning point,” said Christian Freymeyer, researcher and author of the report. “Investors see the value, policymakers see the benefits, and businesses see the inevitability of greater transparency. It’s only a matter of time before tax transparency is accepted and expected of financial disclosure.”

“When representatives from the accounting, investment and tax justice sectors all agree, you know you are headed toward real reform,” added Mr. Kalman.

Specific Policy Recommendations

To better inform investors, the report calls on the U.S. Congress, the Securities and Exchange Commission, and the Financial Accounting Standards Board to specifically require multinational corporations to publicly disclose, on an annual, country-by-country basis:

- Number of entities;

- Names of principle entities;

- Primary activities of entities;

- Number of employees;

- Total revenues broken out by third-party sales and intra-group transactions of the tax jurisdiction and other tax jurisdictions;

- Profit/loss before tax;

- Tangible assets other than cash and cash equivalents;

- Corporate tax paid on a cash basis;

- Corporate tax accrued on profit/loss;

- Reasons for any difference between corporate tax accrued on profit/loss and:

- the tax due if the statutory tax rate is applied to profit/loss, and

- the tax due if the statutory tax rate is applied to profit/loss before tax; and

- Significant tax incentives.

In addition to public country-by-country reporting, the report recommends a number of additional tax-related disclosures (see pages 25–26), which would be useful to shareholders.

###

Notes to Editors:

- Click here to read an online version of this press release on our website.

- Click here to read more about the report.

- Click here to download a PDF of the report.

Journalist Contact:

Clark Gascoigne

Deputy Director, The FACT Coalition

+1 202 810-1334

cgascoigne@thefactcoalition.org