ITEP/PIRG Report Reveals at Least 366 Corporations — 73 Percent — in the Fortune 500 Operate One or More Subsidiaries in Tax Haven Countries

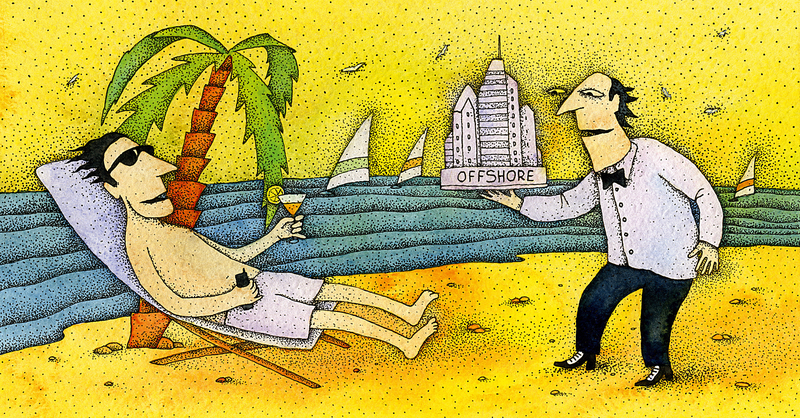

WASHINGTON, D.C. — A new study released Tuesday highlights the widespread use of offshore tax haven loopholes by large multinational companies. The study highlights the danger of congressional proposals to exempt profits booked offshore from taxation, according to the Financial Accountability and Corporate Transparency Coalition (FACT Coalition). Titled “Offshore Shell Games 2017: The Use of Offshore Tax Havens by Fortune 500 Companies,” the report was jointly published by the Institute on Taxation and Economic Policy (ITEP) and the U.S. PIRG Education Fund — both members of the FACT Coalition.

Clark Gascoigne, the deputy director of the FACT Coalition, issued the following statement:

“This study reveals that large multinationals currently have $2.6 trillion booked offshore on which they are avoiding a staggering $752 billion in U.S. taxes.

“As Congress considers proposals to institute a near zero percent tax rate on profits booked offshore by multinational corporations, the findings in this report should give policymakers pause. The study shows that today’s flawed tax system allows for gaming on a grand scale. But we shouldn’t make it even worse.

“Proposals exempting profits booked to offshore tax havens from taxation could well mean that these companies never pay U.S. income taxes again. These tax giveaways hurt middle-class taxpayers who will pay either in higher taxes, larger deficits, or cuts to services they use. That’s why, earlier this month, more than 100 organizations came out against plans by the White House and congressional leadership to open the largest offshore tax loophole in U.S. history.”

###

Journalist Contact:

Clark Gascoigne

Deputy Director, The FACT Coalition

+1 202 827-6401

cgascoigne@thefactcoalition.org

Notes to Editor:

- The full report from ITEP and PIRG Ed. Fund can be found here.

- The joint letter to Congress from 100-plus groups opposing a so-called “Territorial Tax System” is available here.