This past week, FACT Coalition member Global Financial Integrity released a report with a comprehensive state-by-state comparison of what information is required to set up a company versus obtain a library card. Astonishingly, in every state, far more personal information was needed to set up a library card than a company. This is especially startling when you realize the extent to which a company—without an accountable individual attached—could be used to commit crimes with impunity.

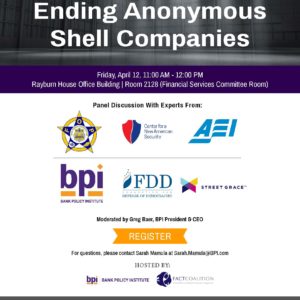

This report came just a week after the House Financial Services Committee’s subcommittee that covers national security issues held a hearing on corporate transparency and efforts to fight money laundering. In the lead up to the hearing Representative Carolyn Maloney (D-NY) released a discussion draft of the Corporate Transparency Act of 2019, which would require the collection of beneficial ownership information. All the witnesses at the hearing supported the collection of beneficial ownership information as an important anti-corruption, anti-money-laundering tool. In fact, all but one witness who testified at hearings in this and the previous Congress in which corporate transparency was discussed have said that beneficial ownership disclosure was an important anti-money-laundering measure. In a blog discussing this month’s hearing, FACT’s Gary Kalman encouraged lawmakers to this time listen to what the witnesses have to say. Anti-human trafficking, faith, and law enforcement organizations also encouraged the committee to take action on anonymous companies.