On Tax Reform, Congressional Leaders Propose Widening Loopholes for Multinationals at Expense of Domestic Businesses and Middle Class Taxpayers

Much of the analysis of the 2016 election reflects on a middle class that feels overburdened. While the economy has certainly improved since the recession, one thing has gotten worse that may be partially to blame—offshore tax haven abuse. A new report from U.S. PIRG Education Fund finds that multinational companies dodge an estimated $147 billion in federal and state taxes annually through offshore tax haven loopholes, shifting that burden instead onto small businesses and individual taxpayers. Titled “Picking Up the Tab 2016: Small Businesses Bear the Burden for Offshore Tax Havens,” the study estimates that each small business, on average, owes $5,186 more on its annual tax bill to collectively make up for the federal and state corporate tax revenue lost to offshore tax havens.

The authors of the report explain the competitive disadvantage caused by tax avoidance:

“Small business owners are hit twice by the effects of tax dodging by large multinational corporations. Small businesses are placed at a competitive disadvantage because they rarely have subsidiaries in tax havens and the armies of tax lawyers and accountants necessary to exploit the loopholes that come with such subsidiaries. Meanwhile, nearly 73% of Fortune 500 companies operate subsidiaries in tax haven countries. Small businesses are forced to compete with multinational corporations based on the cleverness of their tax gimmicks rather than on their innovation or quality of product.”

The multinational companies that benefit from accounting gimmicks and tax schemes also benefit from the services and infrastructure that taxes—paid by small businesses and the middle class—provide. These companies transport goods with our infrastructure, hire our educated workers, receive protection from our police, and benefit from our rule-of-law—all while passing the check on to everyone else.

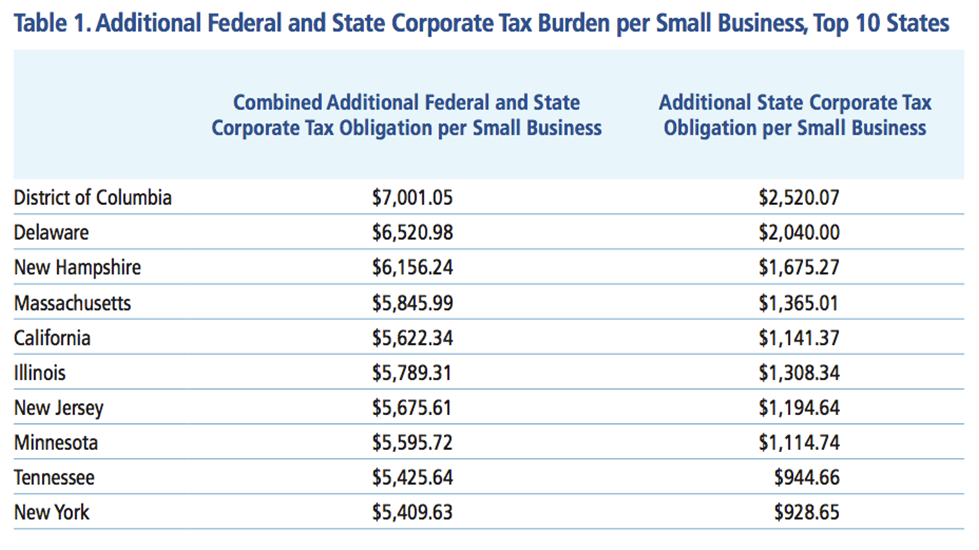

The authors break down the results by state, and some of the findings are stark. Despite Delaware’s status as a tax haven in its own right, each small business owner in Delaware can expect to pay an additional $6,520.98 per year to cover the cost of offshore tax avoidance—more than any other state. Only small business owners in the District of Columbia can expect to pay more: $7,001.05 per year.

Of course, the debilitating effects of tax haven abuse are not limited to DC and Delaware. The following chart ranks the top ten states based on the amount that each small business owner in the state would have to pay to make up for the revenue lost to taxpayers from offshore schemes.

Furthermore, in almost every state, the loss to taxpayers from offshore schemes exceeds $50 million per year—with a majority of states losing hundreds of millions in revenue annually. Since many states require balanced budgets, the burden of lost revenue is quickly felt by small business owners and the middle class.

After a campaign in which both presidential candidates pledged to close loopholes that allow corporations to dodge taxes and to stop companies from booking their profits overseas, will the incoming administration follow through? Though, the president-elect and congressional leaders have said that tax reform is a priority for 2017, the plans that they are floating fall short of closing loopholes and holding multinational companies accountable, and—worse—they could even further disadvantage wholly domestic and small businesses.

Though there are still questions on what it will look like—the tax reform debate is here. Fixing the tax code should include changes that level the playing field between the small, domestic businesses highlighted in PIRG’s report and the large, multinational companies who’ve taken advantage of taxpayers for too long. Real change must not, as we have seen in some proposals, double down on a two-tiered system that favors multinational over wholly domestic companies.

Additional Reading:

- Read the full report from the U.S. PIRG Ed. Fund.

- Read FACT Executive Director Gary Kalman’s Nov. 28, 2016 article on tax reform.

- Read FACT Executive Director Gary Kalman’s Oct. 10, 2016 op-ed inTax Notes on the problems with a territorial tax system.

- Read a FACT Sheet on the problems with territorial tax systems.