This article is cross-posted from the Tax Justice Blog.

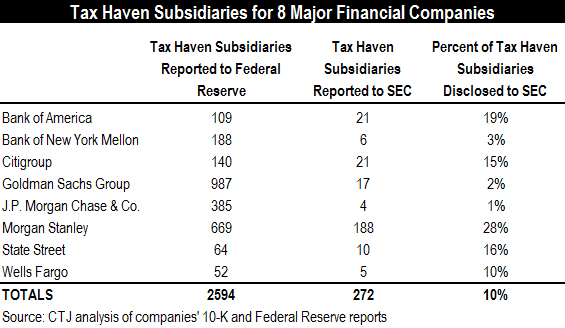

In 2015, Citigroup reported to the Security and Exchange Commission that it has 21 offshore subsidiary companies, but it reported to the Federal Reserve that it has 140. Similarly, Bank of America reported to the SEC that it has 21 subsidiaries while reporting to the Federal Reserve that it has 109. All told, 27 financial firms report wildly different numbers to the SEC v. Federal Reserve.

So what gives and which reporting is accurate? It turns out that SEC has less stringent reporting rules, requiring companies only to disclose “significant” subsidiaries. It defines significant as comprising 10 percent or more of the company’s assets. The Federal Reserve requires broader disclosure, but only for financial companies. A CTJ comparison of the disclosures revealed big banks and other financial firms collectively are under reporting to the SEC the number of subsidiary companies by a factor of more than seven.

Because Federal Reserve requires subsidiary reporting only for financial firms, it’s impossible to fully know the extent to which other Fortune 500 corporations fail to disclose their subsidiaries. But if financial companies’ reporting practices are representative of other corporations, then it is likely under reporting is pervasive.

This week, the SEC closed its comment period for an exposure draft, which is part of its review of disclosure requirements. CTJ, in written comments, urged the SEC to mandate greater corporate transparency by requiring companies to publically disclose all their subsidiaries. Such a requirement would prevent companies from gaming which subsidies they disclose, and it would provide the public and investors with a clearer picture of how public companies operate.

Another critical failure in SEC disclosure requirements is that companies can avoid specifying how much they owe in U.S. taxes on their “offshore” income by claiming that providing this calculation is not practicable. Eighty-two percent of Fortune 500 companies with untaxed offshore earnings used this loophole to avoid revealing what they would owe in taxes. Because of this, the public and investors are unable to determine whether and to what extent companies are engaging in offshore tax avoidance. A study by the financial firm Credit Suisse found that many large companies, including General Electric and Xerox, could face tax liabilities representing 10 percent or more of their total market capitalization. In other words, SEC rules enable corporations to obscure critical information about the financial health of a company.

As CTJ’s SEC comments note, the best way to bring transparency to companies’ offshore operations would be to require companies to report their tax and related information (such as income, number of employees, revenue, etc.) on a country-by-country basis. Companies already keep track of this information for accounting purposes and will soon have to send this information to the IRS anyway, so reporting it in a SEC filing would require no real additional cost.

For more, read CTJ’s full comment to the SEC here or FACT’s comment to the SEC here.