FACT seeks a Policy Fellow to support the Coalition’s growing portfolio at the intersection of environmental crime and illicit finance. If you are interested in joining a pragmatic and winning coalition dedicated to tackling dirty money in the U.S. financial system and environmental crimes around the globe, click here to learn how to apply!

Here is the State of Play

Treasury Advances Implementation of Landmark Anti-Money Laundering Regulations for Real Estate Transactions

Money laundering through U.S. real estate both “distorts housing prices and threatens U.S. economic and national security,” according to the U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN). On November 12 FinCEN released a draft form that will be used by covered individuals to submit critical information on residential real estate transfers pursuant to recently finalized anti-money laundering regulations. Collected data – including information on the true beneficiaries of covered real estate transactions – will be available to federal, state, and local law enforcement in order to curtail the ability of bad actors to hide ill-gotten gains in U.S. real estate markets.

The implementation of Treasury’s real estate rule marks a substantial leap forward for the U.S. anti-money laundering framework, alongside recent progress on ownership transparency for anonymous shell companies and U.S. private investment markets. Reporting under Treasury’s residential real estate rule will begin on December 1, 2025. Comments on the proposed form for covered real estate professionals are due January 13, 2025.

Latest From FACT

Blog: The Crypto Industry is Tether-ed to Illicit Finance: Here’s How to Break the Chain

In his debut blog, FACT policy fellow Omer Niazi argues for the necessity of comprehensive anti-money laundering safeguards for cryptocurrency markets in order to respond to growing risks as anonymous transactions on decentralized finance platforms become more commonplace.

Blog: Takeaways from COP16 on Efforts to Combat Environmental Crimes

Following two weeks of intense discussion, debate and exchange of ideas, read Julia Yansura’s key takeaways from the UN Biodiversity COP 16 in Colombia on efforts to tackle environmental crimes like illegal mining and logging.

FACT urges appropriators to oppose a harmful House measure that would deny funding to the nation’s accounting standards setter unless it withdraws a long-awaited corporate income tax disclosure rule.

Read more about FASB’s final update to corporate tax reporting here.

Read the new letter from FACT and Transparency International U.S. urging Treasury to meet its statutory deadline for important aligning regulations required under the Corporate Transparency Act.

From the letter: “Finalizing these regulations will ensure that the U.S. will not serve as a safe haven for the illicit funds of corrupt officials, America’s adversaries, terrorists, and criminals.

While major progress has been made in 2024 on key anti-money laundering priorities, more work is needed to counter corruption and ensure government integrity and accountability to the public, according to a new letter from FACT and over a dozen anti-corruption, environmental, and good governance CSOs.

FACT in the News

Law360: Wyden’s Pharma Probe Could Build Case For Int’l Tax Reforms

FACT policy director Zorka Milin was quoted in coverage of Senator Ron Wyden’s (D-OR) ongoing investigation into widespread tax abuses in the U.S. pharmaceutical industry.

In particular, Milin noted the failure of the foreign-derived intangible income (FDII) deduction in returning U.S.-developed pharmaceutical patents onshore, despite individual pharma companies like Pfizer claiming hundreds of millions in tax benefit from the provision in recent years.

“They haven’t really paid any tax in the U.S. in the last few years,” said Milin. “So they’re claiming the [FDII] benefit, but it’s not really translating into revenue for us.”

OCCRP: Mining Crimes Pose a Challenge for Law Enforcement, Experts Say

FACT program director for environmental crime Julia Yansura was quoted in extensive coverage of FACT’s latest report on money laundering methodologies associated with environmental crimes in the Amazon region.

“You’ll typically find one government agency that investigates and prosecutes environmental crimes. A different agency works on illicit finance. A third agency investigates or prosecutes drug cases, and a fourth agency works on corruption,” said Yansura. “The problem is, criminal networks have expanded and diversified their revenue streams. It’s very common to find organized crime groups that are committing environmental crimes, trafficking drugs, bribing government officials, and laundering money. So a siloed government response is woefully inadequate.”

From Our Allies

A recent letter to congressional leaders from Transparency International U.S. and five other civil society groups calls for substantive anti-money laundering measures for U.S. cryptocurrency markets. While lawmakers have explored numerous legislative solutions to provide regulatory certainty surrounding cryptocurrency in recent years, the Treasury Department still lacks the comprehensive authorities it requires to ensure that authoritarian and corruption-financed regimes are unable to abuse digital assets to launder money in the U.S.

From the letter: “By closing the regulatory gaps that allow kleptocrats, foreign adversaries, criminals, and others to operate with impunity in the cryptocurrency market, we can take a meaningful step toward safeguarding our financial system and national security.”

Report Reveals How Environmental Crime Profits in the Amazon are Laundered

Robert Muggah, co-founder of the Brazilian-based think tank Igarapé Institute, a FACT Coalition ally, was quoted in Mongabay’s recent coverage of environmental crimes in the Amazon region. According to Muggah, environmental crimes such as illegal mining and deforestation are enabled by U.S. financial secrecy and, in particular, “the abundance of shell companies, front companies and trade-based fraud that allow criminal actors to wash dirty money” in the country.

“To a large extent, U.S. businesses have not historically been required to identify their true beneficial owners to the Treasury Department,” said Muggah. “In the meantime, owing to uneven regulatory oversight and enforcement, U.S. banks have allowed large sums of cash to be transferred in the financial system by individuals involved in corruption, fraud and sanctions evasion.”

Recent Events

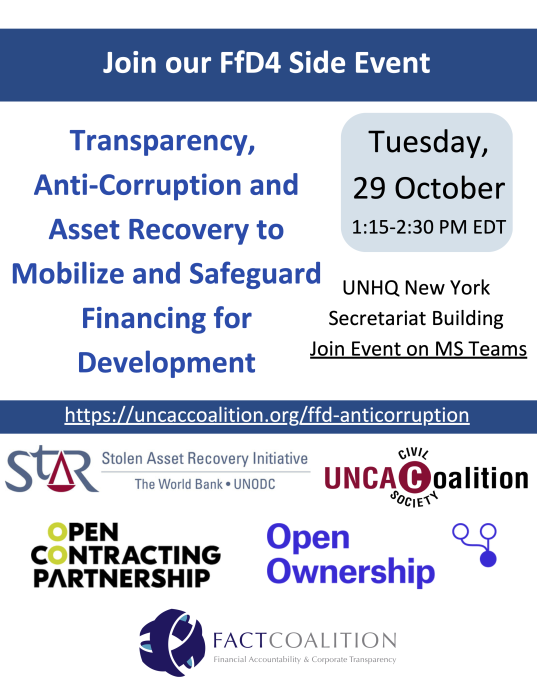

On October 29, FACT executive director Ian Gary appeared alongside experts from the UN’s Stolen Asset Recovery Initiative, Open Contracting Partnership, Open Ownership, and the UNCAC Coalition on an anti-corruption panel held as a part of a preparatory session for the UN’s Fourth International Conference on Financing for Development.

Gary’s remarks focused on the importance of U.S. anti-money laundering reforms to combating global corruption and illicit financial flows, with a particular focus on the ongoing implementation of the Corporate Transparency Act and related ownership transparency measures for U.S. real estate and private investment markets. Each of these three vital reforms represent important steps toward addressing the U.S.’ status as, in the words of Treasury Secretary Janet Yellen, perhaps “the best place to hide and launder ill-gotten gains.”

FACT at COP16 Biodiversity

From October 21 to November 1, FACT program director for environmental crime Julia Yansura attended the COP16 Biodiversity Conference in Cali, Colombia alongside over 14,000 participants from around the world, including government, civil society and the private sector. Yansura had the opportunity to represent FACT at high-level panels and side events, including the following:

- On October 23, Yansura spoke at an event titled Illegal Gold Mining in the Amazon: Transnational Environmental Crime alongside civil society partners from Peru, Colombia and Brazil. The event focused on policy recommendations for governments to more effectively address the challenges posed by illegal gold mining, including combating illicit finance. At the conclusion of the event, a policy brief summarizing the key policy recommendations discussed was published.

- On October 30, Yansura spoke at the launch of World Wildlife Fund’s (WWF) Environmental Crime Financial Toolkit, organized by WWF-UK and HSBC and hosted by the UK Government. Yansura’s comments highlighted the illicit finance threats posed by environmental crimes, including terrorism financing, sanctions evasion and money laundering, and urged financial institutions to do more to understand and address these risks.

- Finally, on October 31, Yansura spoke at a panel hosted by Amazon Underworld on illicit economies in the Amazon. The event included remarks by indigenous leaders, law enforcement, criminologists, and researchers about how crime groups are harming local communities and obstructing conservation efforts.

Hearing: Building on the Success of TCJA: The 2025 Tax Policy Debate

John Arensmeyer, Founder and CEO of Small Business Majority, a FACT Coalition member organization, recently testified before the Joint Economic Committee on the need to incorporate small business demands into any final tax package ahead of the expiration of many provisions of the 2017 Tax Cuts and Jobs Act at the end of next year.

Among other recommendations, Arensmeyer highlighted the need to close loopholes that provide dramatically lower tax rates for the foreign-sourced income of large U.S. multinationals. According to recent polling by Small Business Majority, closing these loopholes is supported by three quarters of small business owners.

About the FACT Coalition